Volume of PE-backed IPOs already up 25% year-on-year

Initial public offerings have proven to be a more popular exit route this year, with the number of listings already up by more than a quarter compared to the whole of 2016 - although a lack of mega IPOs means aggregate value is still lagging. Greg Gille reports

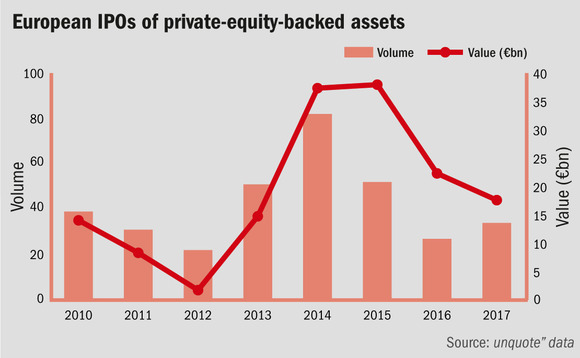

It may not turn out to be among the great vintage years of frenzied listing activity, but 2017 has certainly seen the IPO window reopen and GPs have been eager to capitalise. With a couple of months still left in the year, the volume of listings for private-equity-backed assets in Europe has already exceeded the figure recorded by unquote" for the whole of 2016: Europe has been home to 34 IPOs of portfolio companies between January and October, against 27 for the entirety of 2016.

This revival has notably intensified in early Q4, with nearly a quarter of the 2017 listings taking place in October alone. Some of the highlights of recent weeks include Rocket Internet floating HelloFresh on the Frankfurt Stock Exchange at €10.25 per share, valuing the business at up to €1.7bn; and the €954m listing of Triton-backed Befesa on the same exchange. Sandro Maje and Claudie Pierlo (SMCP), a French clothing retail group backed by KKR, also listed with a €1.5bn market cap on Euronext Paris at the end of October.

With a number of potential IPOs on the horizon (including that of Norvestor-backed Norwegian technology consultancy Inmeta Crayon), year-end figures could approach, but are unlikely to exceed, the 52 listings seen in 2015. The incredibly high number of IPOs recorded in 2014 (82) remains a lofty target to aspire to.

This can be partly attributed to the fact that private-equity-backed IPO activity has been fairly uneven across the European markets. The Nordic countries have been buoyant, as recently explored by unquote", accounting for 30% of all European listings so far this year. The UK has also been active, but slightly less so than in previous years when looking at overall European market share (20% so far in 2017 versus 33% over 2014-2015). And France has seen comparably few listings, with only three recorded so far this year, including the aforementioned SMCP.

Big money

Looking at the aggregate value of the flotations that have taken place so far this year also puts the 2017 IPO revival in perspective. With a combined market cap of €17.6bn, this year's raft of listings still has some way to go to equal the €22.4bn recorded for the whole of 2016 – although a handful of heavy hitters in the last two months of the year could arguably push it past that mark. Again though, the comparison with 2014 and 2015, when value aggregates broke the €37bn mark, is less flattering.

This is not only a factor of a higher number of listings in each of these years, but also the sheer size of individual IPOs. On the one hand, the viability of listing as an exit route has filtered down the value scale in 2017, but on the other hand the number of IPOs in excess of €2bn (and those breaking the €5-6bn mark) has also dwindled. unquote" recorded an aggregate market cap of €20bn over just five listings in excess of €2bn in 2015; so far this year, only VC-backed Delivery Hero has broken the €2bn market cap mark.

Sponsors are not necessarily losing out though. Part of the reason why IPOs, while undeniably more popular than last year, have not quite reached the fever pitch witnessed in 2014-2015 is also down to the frothiness of the M&A markets. With entry multiples still on the rise, dual-track processes can just as easily swing back the private way at the 11th hour, as DH Private Equity's sale of TMF has recently shown (the business was gearing up for a London listing before CVC clinched it for €1.75bn at the end of October).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater