Articles by Greg Gille

Trade buyer appetite boosts mid-cap valuations

Mid-cap valuations

Siparex raises €200m for MidMarket III fund

French GP Siparex has held a final close for its MidMarket III vehicle on €200m, exceeding its €150m target. Greg Gille reports

Iceni sells Mentor IMC to Vinci for 6x return

Iceni Capital has sold oil & gas recruitment business Mentor IMC to French group Vinci in an all-cash transaction, reaping a 6x multiple.

EdRip's Cetal in OBO

Edmond de Rothschild Investment Partners (EdRip) has taken part in the owner buyout of its portfolio company Cetal, a French manufacturer of heating elements.

Mid Europa promotes six

CEE-focused firm Mid Europa Partners has promoted six team members.

Cautious optimism in France as government unveils pro-business policies

New research by trade body Afic reveals improving sentiment among local GPs in the second half of last year – a positive trend likely to be further boosted by the government’s newfound social democrat leanings. Greg Gille reports

HIG provides unitranche to support Steelite MBO

HIG WhiteHorse, the credit arm of HIG Capital, has supplied tableware business Steelite with a £29m unitranche facility to allow management to secure full ownership.

SEP sells ControlCircle to Alternative Networks

Scottish Equity Partners (SEP) has sold hosting and cloud-based services provider ControlCircle to Alternative Networks for £39.4m.

TCR in SET Environnement MBO

TCR Capital has invested in the management buyout of SET Environnement, a French business specialising in asbestos removal.

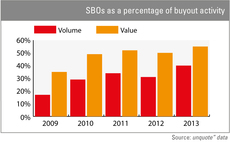

SBOs hit new peak in 2013

Secondary buyouts rose to new levels of prominence in the European market last year, accounting for 40% of all buyouts and 55% of aggregate buyout value. Greg Gille reports

Partners Group teams up with Mizuho

Partners Group and Mizuho have joined forces to develop and distribute global private equity products in Japan's pension market.

Nesta Impact fund deploys £2m in first investments

Nesta Investment Management has made its first social impact investments, deploying £2m across four businesses.

Abraaj buys Turkish dairy business Yörsan

The Abraaj Group has taken a majority stake in the buyout of Yörsan Group, a Turkish manufacturer and distributor of dairy products.

KKR and Permira fully exit ProSiebenSat.1

KKR and Permira have fully exited German media company ProSiebenSat.1, selling their remaining 17% stake, valued in the region of €1-1.3bn.

SVG shares down 8% as Aegon sells stake

Aegon has sold a 7.5% stake in listed private equity investor SVG Capital, resulting in an 8% share price drop.

Insurers to ramp up private equity exposure in 2014

Insurers are rethinking their investment strategies and beginning to increase their exposure to private equity. Some are even looking at it from an asset-liability management perspective.

France's Access holds €190m first close for FoF

French funds-of-funds manager Access Capital Partners has held a first close on €190m for its latest vehicle, Access Capital Fund VI Growth Buy-out Europe (ACF VI).

Travers grabs major new client as Apollo reviews UK roster

US private equity house Apollo has carried out a review of its UK legal advisers, with Travers Smith on the roster for the first time alongside Slaughter and May, Ashurst and the London arm of Sullivan & Cromwell.

Chequers acquires ISS division

Mid-cap GP Chequers Capital has acquired ISS Espaces Verts, the French landscaping division of EQT portfolio company ISS.

PAI reaches halfway line with €1.4bn first close

French private equity house PAI partners is understood to be halfway towards the hard-cap of its latest vehicle, PAI Europe VI.

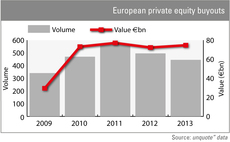

2013 buyouts: overall value stabilises around €75bn

The overall value of European private equity-backed buyouts has hovered around the €75bn mark for the third year in a row, with last year's deals totalling €74.7bn.

Apollo raises $17.5bn for Fund VIII

Apollo Global Management has bucked the trend of large-cap players downsizing their funds compared to pre-crisis efforts: the firm has amassed $17.5bn for its latest global vehicle after a little more than a year on the road.

EdRip hires new life sciences partner

Edmond de Rotschild Investment Partners (EdRip) has hired Dr Naveed Siddiqi as a partner in charge of the firm's Biodiscovery venture capital funds.

MBO Partenaires backs Cofigeo SBO

MBO Partenaires and Société Générale Capital Partenaires have acquired a stake in the buyout of French ready-meals specialist Cofigeo.