Articles by Katharine Hidalgo

VC Profile: Speedinvest

Seed investor is opening a new office in Paris as part of the expansion of its pan-European platform

Limerston supports AdviserPlus in acquisition of Halborns

Limerston acquired HR consultancy AdviserPlus in November 2016, drawing equity from its debut fund

Gilde Healthcare V close on $450m hard-cap

Legal advice was provided by a team from Jones Day led by partner Quirine Eenhorst

Arbor's Steelite acquires Homer Laughlin food subsidiaries

Arbor acquired Steelite International drawing from Arbor Investments IV in December

BGF invests £8m in Emma Bridgewater

Funding will go towards the company's expansion in the UK, as well as in international markets

Tenzing hires Elliott

Elliott will continue to lead Tenzing's Entrepreneurs Panel, which he has been doing since 2017

Revo Capital Fund II holds first close on €40m

Domiciled in the Netherlands and structured as a BV, the fund has a 2% management fee

Investors participate in $34m series-B for SoftIron

Founded in 2012, SoftIron designs and builds purpose-built data-centre appliances

Accel in $20m series-B for Humio

US-based Accel is currently investing from its London VI vehicle, which closed on $575m

Preservation Capital Partners Fund I holds first close

To date, PCP I has mainly institutional investors from both North America and Europe

Blackstone to continue preparations to acquire NIBC

Blackstone's offer comprises 995 euro cents per share, including the final dividend of 33 cents

PE-backed BMS acquires Jurado Mata

BMS's backers invested in the company in June 2019, in a deal that gave it an EV of £500m

August-backed Amtivo acquires Certification Europe for €6m

Based in Dublin and founded in 1999, Certification Europe has offices in the UK, Japan and Italy

Dunedin exits Kingsbridge

Kingsbridge was a Dunedin Buyout Fund III portfolio company, which closed on £300m in June 2013

Nordic buyout market has silver linings, despite low volume

Nordic region sees the lowest quarterly deal volume since Q4 2013, with just 17 buyouts in Q1 2020

UK holiday parks advised to close: Portfolios affected

British Holiday and Home Parks Association has advised its members to close all holiday parks

UK industry welcomes rescue package, but concerns remain

Package includes £330bn in loans, £20bn in other aid and a postponement of business rates

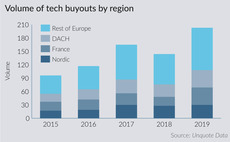

Technology buyouts stall in Nordic region

Technology buyouts have hovered around the 30-per-year mark for three years running now, suggesting a plateau has been reached

Axia buys insurance business Direct Gap

Gordons provides legal advice and Naylor Wintersgill provides financial due diligence services

CBPE sells SpaMedica to Nordic Capital-backed Ober Scharrer

Nordic Capital is currently investing from its ninth fund, Nordic Capital IX, which closed on €4.3bn

Inflexion-backed Huws Gray acquires AC Roof Trusses

Inflexion acquired a minority stake in Huws Gray in April 2018 using its Partnership Capital Fund I

ECI-backed IT Lab acquires Sol-Tec

Unquote understands ECI Partners provided no fresh equity for the acquisition of Sol-Tec

UK sees advisory boom amid PE market maturation

UK & Ireland sees an increase in the number of corporate finance firms participating in PE deals to more than 160

ESO backs facilities service Churchill

Current executive directors Joel Briggs and Phil Moxom will continue to lead the company