Articles by Eliza Punshi

Capidea acquires Obsidian Group

Deal follows an auction process initiated by the company at the end of summer 2020 and was led by Deloitte.

Silverfleet promotes two to partner

Knight is based in London while Sommer is based in Silverfleet's Munich office

NPM Capital to sell Deli Home to Ardian

NPM reportedly based the sale on an EBITDA figure for the retailer of roughly €40m

Superhero Capital to close second fund by mid-summer

Fund was previously aiming for a final close by the end of 2020

THL, EQT sell stake in AutoStore to Softbank for $2.8bn

THL will continue to be a majority shareholder and EQT, which sold its majority stake to THL in 2019 but retained 10%, will also still be invested

Nordic Fundraising Pipeline - Q1 2021

Unquote rounds up notable fundraises ongoing across the Nordic market, including EQT, Axcel, CapMan, Saga, and more

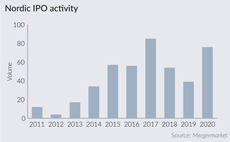

Nordic IPO rush drives exit opportunities for GPs

Wave of Nordic IPOs shows no signs of receding this year, often driven by new opportunities emerging from the pandemic

Armada Credit Partners closes fifth fund on €210m

Fund V is already 50% deployed and has made seven investments so far

Hg acquires Trackunit from Goldman Sachs, Gro Capital

Sale comes nearly six years after the GPs acquired the company

Klar Partners closes debut fund on €600m hard-cap

GP started raising the fund in March 2020 and said the vehicle was "significantly oversubscribed"

Nordic Capital acquires minority stake in Leo Pharma

GP's stake is reportedly smaller than 25%, with the current owner remaining as the majority shareholder

Carlyle Group to acquire End Clothing

Company founders will retain minority stakes while Index Ventures will exit

Triton reaps 2.4x return on sale of Logstor

Deal comes more than seven years after Triton invested in Logstor via Triton Fund III

Litorina-backed Embellence Group to list

Listing comes more than a decade after Litorina acquired a 66% stake in wallpaper manufacturer ECO-Boråstapeter

EQT sells Desotec to Blackstone

Deal reportedly values the company at an EV of around €800m, corresponding to a multiple of 27x EBITDA

VC Profile: OpenOcean

Software-focused VC held a second close on €92m for its third main fund in February, and plans to reach €130m before the end of H1

Ferd acquires IT firm Norkart

Mergermarket reported in December 2020 that Norkart was being marketed based on EBITDA of around NOK 83m (€7.8m)

Palamon, Corsair in £165m dividend recap for Currencies Direct

GPs reportedly mandated William Blair in December 2020 to explore strategic options

Queen's Park Equity backs MBO of Encore Group

Founding partners Stephen Chard and Neil Robinson will also retain a stake in the business

Brygge Partners invests in Tier 1 Asset

Founder and CEO Peter Hemicke will reportedly own 57.5% while board chaiman Lars Aean purchased 5%

BC Partners acquires Davies

Existing investors, US-based PE firm HGGC and Canadian firm AimCo, will remain invested with minority stakes

Inovia Capital closes second growth fund on $450m

Inovia will use the new fund to grow its presence in the UK and Europe

Ceder Capital acquires Kaffekapslen

After the transaction, Kaffekapslen's management team will own around 45% of the company

OpenOcean and Spintop lead €3.6m series-A for Cambri

Lynda Clarizio, former president of Nielsen US Media, joins the board of directors