Articles by Oscar Geen

DACH GPs consider alternative funding models

With three of the region's top five most active GPs investing from non-standard funds in 2017, some other GPs are also adopting alternative approaches

VC firms in €20m round for Flaschenpost

Latest round was led by Portuguese family office Sociedade Francisco Manuel Dos Santos

ECM approaches first close for GEP V

ECM targets control positions in DACH-based businesses with enterprise values between €20-80m

Hg sells Teufel to Naxicap

GP makes the divestment from HgCapital 6, a £1.87bn vehicle that held a final close in 2009

Nimbus buys H van Wijnen

Nimbus generally invests in medium-sized businesses with turnover between €10-500m

Finatem buys Mungo Befestigungstechnik

Selling consortium includes the CEO, Oliver Annaheim, who will retain a minority stake

Kerogen leads €15m funding round for Ideol

Amundi Private Equity, Sofimac Regions and Paca Investment are also subscribing to new shares

VR Equitypartner, SüdBG sell Piller to Riflebird

Fresh capital from the transaction will be used to drive Piller's expansion into the US and Asia

Capnamic, ProFounders lead €4m series-A for NDgit

Existing investor Dieter von Holtzbrinck Ventures also takes part in the financing round

BC-backed Springer Nature sets price range for €3.6bn IPO

Company is targeting proceeds of up to €1.6bn from the primary and secondary offering

Verdane buys portfolio from Bauer Media Group

Portfolio comprises three German companies including women's fashion brand Navabi

Blossom, Atomico in $10m series-A for Fat Lama

Atomico also takes part in the financing alongside startup accelerator Y Combinator

VC-backed NFon sets price range for €200-239m IPO

Company aims for a post-money market cap of €200-239m and a free float of up to 68.9%

Golding hires BlueBay's Das as head of private debt

Das will be responsible for selecting primary, secondary and co-investment opportunities

VC firms lead $29m series-B for Clark

Coparion, Kulczyk Investments and Yabeo Capital also take part in the latest financing

Verdane-backed Lingit buys Claro Software

GP acquired Lingit in April 2017, drawing equity from the SEK 3bn buyout fund Verdane Capital IX

EQT partially divests EIS Aircraft Group

EQT remains invested in the EIS Aircraft Products and Services division

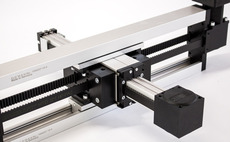

IK buys Bahr Modultechnik

GP draws equity from IK Small Cap II, a €550m fund that held a final close in February 2018

UK and Ireland small-cap soars amid general buyout lag

Overall UK buyout activity in Q1 is down by almost a third year-on-year, though dealflow in the small-cap space remains near record levels

Index leads $5m series-A for ClauseMatch

Talis Capital joins the round alongside existing investors including Speedinvest

Mobeus backs Hemmels

Fresh capital will be used to scale up the company's engineering and research and development teams

Sofinnova hires in-house counsel from Eurazeo

Bordes will work in Sofinnova's support team alongside managing partner and COO Monique Salnier

Californian pension fund seeks adviser to build PE exposure

Adviser will work on the development of StanCera's diversified private markets portfolio

Mangrove leads €3.2m series-A for Adverity

Existing investors Speedinvest, 42Cap and AWS Gründerfonds also take part in the round