Articles by Katharine Hidalgo

From PE darling to hard-hit sector: gyms face uncertain post-covid future

As gyms and fitness clubs across Europe gear up to welcome back consumers, Unquote explores their tricky path out of lockdown

Eurazeo-backed Planet acquires 3C Payment

Planet is said to pay between the high millions and low tens-of-millions-of-euros on an acquisition

Inflexion-backed ONP invests £1.5m in Lavatech

Founded in 2013, Lavatech is the developer of legal app InCase and is based in Manchester

SoftBank in $19.5m in Splyt series-B

SoftBank vice-president Daichi Nozaki will join the company's board of directors

EQT sells credit business to Bridgepoint

There were five or six bidders in the early stages of the sale auction, including Schroders

Hoxton closes second fund on almost $100m

Hoxton Ventures II has a 30% carry rate with a 2.5% management fee and no hurdle

KKR to acquire Roompot from PAI

At the beginning of 2020, PAI hired Rothschild to sell the company for an expected valuation of €1bn

Seventure, Vostok lead $10m round for TransferGo

Venture capital firms Hard Yaka, Revo Capital and Bootstrap Europe also participate

Corten closes debut fund on €392m

Corten began raising in January 2019, thus avoiding potential delays in the current market

VCs invest £60m in Monzo for £1.24bn valuation

Online bank's previous ТЃ113m funding round valued the company at ТЃ2bn in June 2019

Livingbridge invests in Chill Insurance

Financing for the acquisition of the insurance broker has been provider by Pemberton

IQ appoints Hirtzel as general partner

Hirtzel previously served as chief operating officer of Kreos Capital after working at PA Consulting

Zamo invests in SASC

Zamo Capital I, the firm's debut fund, has made its first investment in investment manager SASC

LDC takes minority stake in Connect Health

For the year ending on 30 June 2019, Connect Health reported revenue of ТЃ31.2m, up from ТЃ25.4m

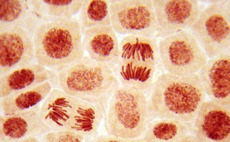

Foresite et al. in $41.5m series-A for Bit Bio

Foresite is currently investing from its fourth-generation fund, which closed on $668m in 2018

NB closes Euro Crossroads 2018 fund on €260m

LPs in previous Crossroads vehicles include the Iowa State University Foundation and WSI Investments

Blackstone Life Sciences invests $337m in Medtronic's diabetes arm

Medtronic, headquartered in Dublin, Ireland, is a medical technology, services and products company

Astanor leads series-A round for Hyris

Neos Medica, IDB Holding т the holding company controlling Indena т and Pi Campus also participate

LDC-backed Linley & Simpson acquires Link Agency, Dawson Wake

Previous acquisitions were financed by Santander Corporate and Commercial Banking

Livingbridge invests in TitanHQ

Investment in the cloud security company is made through Livingbridge's Enterprise 3 fund

Bridgepoint-backed Fat Face in debt-to-equity swap – report

Deal would reduce Fat Face's present ТЃ120m borrowing levels via a debt-for-equity swap

BBB appoints Lewis La Torre as interim CEO

In October 2019, Keith Morgan announced that he would be standing down from the role of CEO

Maven invests in Redwigwam

Steve Harris joins as MD for technology and operations while Dawn Paine becomes marketing director

BGF invests €10.5m in Edgescan

BGF's investment is the first external capital or financing received by the company to date