Buyouts

Gilde Equity Management acquires BlueCielo

Gilde Equity Management has bought Dutch software company BlueCielo from a group of financial and private shareholders.

UK Watch: Smaller buyouts still growing

The UKтs smaller buyout space has gone from strength-to-strength in the second quarter of 2012, according to figures in the latest unquoteт UK Watch, in association with Corbett Keeling.

Oaktree Capital buys Integrated Subsea Services

Oaktree Capital Management has acquired a 62.5% stake in Integrated Subsea Services (ISS), according to reports.

Capvis and Partners Group sell Bartec to Charterhouse

Capvis Equity Partners and Partners Group have sold their majority stake in German industrial safety technology provider Bartec to Charterhouse Capital Partners.

Edge backs Working Partners and Beast Quest buyouts

Edge Performance VCT has supported the two companies acquiring UK-based publishing businesses Working Partners and Beast Quest.

KPMG CF private equity head McDonagh leaves

Michael McDonagh is heading to Liberty Corporate Finance from 1 October. He has headed KPMGтs UK corporate finance private equity practice since 2005.

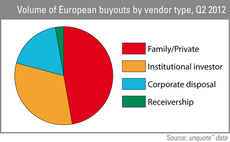

SBOs remain resilient in Q2

The increase in larger deals witnessed in the second quarter corresponded with a relative resilience in secondary buyout activity across Europe, according to the latest unquote" Private Equity Barometer.

RJD buys Harrington Brooks from Inflexion

RJD Partners has backed the MBO of British debt management firm Harrington Brooks from Inflexion Private Equity.

Nordic Capital buys four consumer financing firms

Nordic Capital has acquired Swedish consumer financing, insurance and business support services providers Resurs Bank, Solid FУЖrsУЄkringar, Reda Inkasso and Teleresurs.

Equistone acquires EuroAvionics

Equistone Partners Europe has acquired EuroAvionics Holding, a manufacturer of civil certified systems for the aviation industry, from Varde Investments Ireland.

Francisco Partners takes Kewill private

Francisco Partners has acquired British logistics software provider Kewill, previously listed on the London Stock Exchange.

Norvestor acquires Abax

Norvestor Equity has bought Norwegian electronic trip logs provider Abax in a management buyout.

Vespa Capital acquires Abylsen

Vespa Capital has taken a majority stake in French energy and technology consulting firm Abylsen.

KKR acquires WMF shares from Capvis

Kohlberg Kravis Roberts (KKR) has bought a 37% capital stake in German cutlery and coffee machines maker Württembergische Metallwarenfabrik (WMF) from Capvis Equity Partners-managed Crystal Capital for €238m.

Magnum buys Geriatros

Magnum Capital has acquired Spanish care services provider Geriatros.

Finatem acquires WST

Finatem Beteiligungsgesellschaft has acquired a majority stake in WST Präzisionstechnik, a specialised manufacturer of precision parts, as part of an MBO from the company's private owners.

G Square buys Mikeva from Intera

G Square Capital has acquired Finnish social care services provider Mikeva from Intera Partners.

Providence acquires HSE24 from AXA PE

Providence Equity has acquired Germany-based international home shopping group Home Shopping Europe (HSE24) from AXA Private Equity for an estimated €650m.

Palero Capital acquires Tesa Bandfix

Luxembourg-based GP Palero Invest has acquired Switzerland-based Tesa Bandfix from its German parent Tesa SE in an all-equity transaction.

Litorina backs Gullbergs MBI

Litorina has acquired a majority stake in Swedish office supplies provider Gullbergs.

BlackFin Capital Partners acquires MisterAssur

BlackFin Capital Partners has wholly acquired French insurance aggregator MisterAssur.

AXA PE nears €1bn Fives deal

Charterhouse is set to sell French engineering company Fives to AXA Private Equity and the company's management, according to reports.

Providence to acquire HSE24 from AXA PE

Providence Equity Partners is to acquire a majority stake in AXA Private Equity-held German shopping channel Home Shopping Europe (HSE24), according to reports.

Octopus makes 2.5x money on AVM exit

Octopus Investments has realised its stake in British visual communications systems business AVM through an SBO backed by Alcuin Capital, returning 2.5x money to investors.