Early-stage

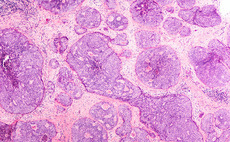

BPI France, Omnes lead €12m series-A for AlgoTherapeutix

Company intends to use the proceeds to finance the clinical development of its lead candidate ATX01

VCs in €100m round for SellerX

Cherry Ventures, Felix Capital and Triple Point Capital have backed the seed round

Voima Ventures leads €2m round for Betolar

Startup will use the proceeds to start the commercialisation of its product to global markets

Eight Roads, Balderton lead $30m series-B round for Tibber

Alongside equity, the company secured $35m in debt financing from Nordea

Kurma, Sunstone lead CHF 20m round for Synendos Therapeutics

Investors including HTGF also backed the central nervous system disorder therapy developer

Innovestor leads €1.1m seed round for Linear

Startup will use the proceeds for future growth and expansion to new markets

MIG leads €39m series-A round for IQM

"Deep tech" startup has so far raised тЌ71m since being founded in 2018

Momeni Digital et al. in funding round for Bullfinch Asset

Elevat3 Capital and German energy group EWE also back the green project-financing platform

Vækstfonden et al. in €1.1m seed round for Kaffe Bueno

Startup plans to use the seed funding for launching new products, scaling up production, growing its team and to cover costs for patents

LifeX raises €6m from Cherry, Vækstfonden et al.

Startup has raised тЌ15m in funding since being founded in 2017

Lunar raises €40m in series-C funding

Startup has so far raised more than тЌ100m and is backed by VC firms Seed Capital, Greyhound, Augustinus, Socii and private investor David Helgason

German biotech firm Topas raises €22m in series-B round

Biotech company has raised €40m in equity financing since 2016

Northpond, Octopus lead $30m series-A for Ori Biotech

Existing investors Amadeus Capital Partners, Delin Ventures and Kindred Capital also join the round

Newion leads €2.5m round for Mediatool

Financing round is aimed at bettering marketing campaign management for global brands and realising growth targets

Novartis, Novo lead €9m series-A for Rappta Therapeutics

Round also saw participation from family office Advent Life Sciences, and Business Finland

Bonnier, Frog lead €15m series-B round for Winningtemp

HR technology startup has so far raised тЌ18.5m since being founded in 2014

Sabadell Asabys et al. lead €14m series-E for MedLumics

Previous backers Andera Partners, Caixa Capital Risc and Innogest Capital also take part in the funding round

Global Founders, Rocket et al. in £21m round for Knoma

Knoma says it will initially focus on the UK market, and plans to expand globally in the coming years

CDP Venture Capital leads €15m series-C for Wise

Indaco and Eureka also take part in the round, alongside previous backers including Principia and HTGF

Norrsken, EQT Ventures et al. in $10m round for Einride

Electric trucks startup has raised $42m in financing since being founded in 2016

Eir Ventures leads seed funding round for Synklino

Startup focuses on developing therapies against viral infections

PandaScore raises $6m in round led by V13 Invest

Startup has so far raised around €9m, according to Crunchbase

Seed Capital leads €4m funding round for BotXO

Around тЌ2m comes from Seed Capital, while VУІkstfonden is providing a syndicated loan of тЌ1.8m

Blue Horizon leads €47m series-B for Mosa Meat

Company will use the financing to develop an industrial production line, expand its team and introduce its products on the market