Expansion

Eurazeo et al. invest €110m in ManoMano

Eurazeo buys a minority stake in French online marketplace ManoMano investing €50m

Octopus et al. in $42m series-B for Elvie

Company will use the financing to increase its investment in R&D and expand internationally

NVM invests £2m in Pure Pet Food

GP drew capital from its VCTs for the investment in the UK-based pet food company

Rockaway Capital backs $6.9m series-B for Gjirafa

Fresh capital will be used by the firm to scale its current products across the region

VCs in €10m series-A for Fliit

Fresh capital will be used for international expansion and the development of the Fliit platform

GIC backs CitizenM in €2bn deal

Sovereign wealth fund and previous backers KRC and APG invest €750m in the Dutch hotel operator

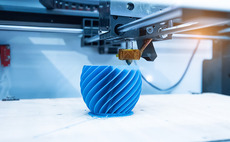

Endeit leads $18m funding round for 3D Hubs

Participating investors include Hearst Ventures, EQT Ventures, Balderton Capital and two angels

Cita Investissement backs Atrium Capital

Cita is sponsored by sovereign wealth funds BPI France and Kuwait Investment Authority

IK supports Klingel's acquisitions of Bächler, Gehring

Klingel is an IK VIII fund company and was acquired by the firm in 2018 from Halder

MIP invests in shoe designer Manebí

Company plans to use the fresh capital to expand internationally and broaden its product offering

Magenta Partners backs FastPayHotels

Following the deal, Tom Matthews, partner at Magenta Partners, will join the company's board

TowerBrook acquires minority stake in GBA Group

Second minority investment in a founder-led business in the UK for the private equity house

Go Capital et al. invest €4.1m in Graftys

Graftys sells products in 25 countries and plans to penetrate new markets with the funding

Time for Growth invests €10m in Oslo

Time for Growth buys minority stake in France-based digital transition specialist Oslo

Unigrains, Sofiproteol back Caussade Semences

Agri-business-focused GPs back a seed production group Caussade Semences Group

Nauta Capital leads £1.5m round for BlackCurve

Mercia Fund Managers, which backed the company in 2018, also takes part in the funding round

Octopus Investments injects £3.3m into Veeqo

Company plans to use the funding to consolidate its position in the UK market and expand in the US

General Atlantic et al. invest €150m in Doctolib

Fresh capital by new and previous investors will help Doctolib foster expansion abroad

Beech Tree supports Learnlight for Arenalingua bolt-on

Beech Tree used funds from its Beech Tree Private Equity Fund II to acquire Learnlight in 2017

C5 Capital in $17m series-B for Blue Cedar

C5 Capital uses its C5 Cyber Partners II fund, despite not yet holding its first close

Atomico leads €30m series-B extension for Peakon

Investment brings the total volume of Peakon's series-B to тЌ48m, following a round in February 2018

Mirabaud invests €10m in sports apparel brand Le Coq Sportif

GP deploys capital from its Mirabaud Patrimoine Vivant fund, which closed on €150m in 2018

VGC injects £2m into WIT Fitness

Sportswear retailer and gym operator will launch its hybrid stores in the US and continental Europe

White Star invests $10m in Packhelp

Existing investors Speedinvest, ProFounders and Market One Capital also take part