GPs

Motive bolsters VC arm with embedded/capital acquisition

Recently created practice supported by USD 200m fund gets a foothold in Berlin

Haul of large funds closings in Q1 2023 clouds new managers outlook – conference

Good news is drop in valuations could feed good vintages in the coming years, participants at SuperInvestor tell Unquote

Women in PE: Triton's Meier-Kirner on deploying in times of crisis and resisting herd mentality

Pan-European sponsor aims to back undervalued businesses and those with structural tailwinds using learnings from past crises

Bridgepoint on track for H1 2023 Fund VII final close

Listed GP noted in an FY22 trading update that the challenging market is delaying most fundraising processes

Fundraising power balance shifts to LPs – panel

Panellists at SuperInvestor conference in Amsterdam discuss how GPs can grab LPsт attention in a challenging market

The Bolt-Ons Digest – 11 November 2022

Unquote’s selection of the latest add-ons including Hg and ICG's Iris, Inflexion's THE, Bain's House of HR and more

3i plans over GBP1bn in exits with 'better' 2023 in sight

Positive turn to start by Q2; retailer Action valued at GBP 8.6bn, CEO said during results call

Ardian reinvests in Neopharmed alongside NB Renaissance

French GP will move stake from fund VI to VII; additional capital allows for European M&A

GP Profile: Investcorp's GP stakes strategy sees strong dealflow ahead

Growing private assets market and changing LP perception will bolster GPтs mid-market strategy, Anthony Maniscalco tells Unquote

EV Private Equity promotes Kobayashi to partner

Karem Kobayashi will also become head of responsible investment at the energy sector-focused investor

Sun European exits Allied Glass to trade for GBP 315m

Sale of UK-based glass packaging group to Verallia marks first exit from Fund VII

NorthEdge appoints Grant Berry as executive chair

UK lower mid-market GP also announces new CIO and other promotions in leadership team

Nordic exits The Binding Site to trade in 'best ever' deal

GP to reap for 19x money in sale of specialty diagnostics group after 11 years, source says; Five Arrows also exits

Nuveen buys Arcmont, forming Nuveen Private Capital

Minority investor Dyal Capital exits stake, deal comes amid a buoyant private lending market

GP Profile: Equistone banks on experience to ride through the next cycle

As the firm contemplates future fundraising, Unquote speaks to partner Tim Swales about the GPтs current outlook

Agilitas registers Human Impact Fund

Filing comes amid host of European sponsors launching debut dedicated impact vehicles

Women in PE: Avallon's Pakulska on fundraising, exits and the role of sport in business

Women in Private Equity is a new series aiming to highlight both news and personal insights from key women in the PE sector internationally

Ardian exits Unither to GIC, IK-led consortium

Existing investors Keensight and Parquest to remain in share capital alongside company's management

Permira Advisors shuts down Japan office

GP spokesperson says strategy is unchanged, will pursue opportunities in Japan selectively

PAI hires Odaro as head of ESG and sustainability

Denise Odaro joins from her role as head of IR and sustainable finance at the World Bank's IFC

Financial Services Capital hires Kieren in IR team

Geraldine Kieren joins the sector-focused sponsor from Aksiaтs private markets team

The Bolt-Ons Digest – 17 October 2022

Unquoteтs selection of the latest add-ons with Equistone's Ligentia, Bridgepoint's Infinigate, Ambientaтs Namirial and more

Alantra-backed 33N aims for Q1 close for EUR 150m cybersecurity fund

Debut manager will deploy tickets of EUR 10m across 14 venture capital investments

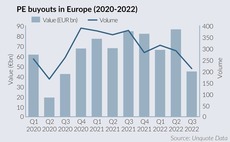

Private equity buyouts hit lowest point since COVID

Amid macro uncertainty, sponsors see EUR 44.6bn deployed across 211 buyouts, in the lowest mark since Q3 2020