GPs

Volpi kicks off fund III deployment with Xalient buyout

Tech GP says specialist focus gave edge in competitive sale; will grow cybersecurity group with M&A

Inflexion hires talent director from British International Investment

Freddy West will work with portfolio companies to accelerate businesses via human capital strategies

BVCA Summit: PEs take long-term view to ride out uncertainty

Unquote reports on discussions around ESG, continuation funds and PE democratisation at last week’s event

Agilitas bolsters team with two new hires in London

Philip Krinks, Arnaud Moreels join pan-European sponsorтs ESG and investment teams

Nordic Capital nears EUR 9bn final close for Fund XI

Expected to be 50% larger than its predecessor, new vehicle took six months to raise

BVCA Summit: "smart and ethical decisions" needed from PE, minister says

Economic Secretary Richard Fuller spoke about the industryтs role in the governmentтs growth plan

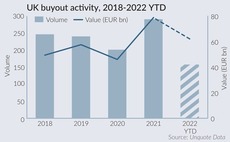

Down but not out: UK PE market confident in spite of sterling, macro concerns

Sponsors prepare to weather the storm and seize opportunities emerging from the crisis

Cathay reinforces PE team with a 14th partner for Paris office

French investment firm with USD 5bn AUM has appointed former Somfy VP Jean-Marc Prunet as partner

Novalpina fund exits Laboratoire XO to Stanley Capital

French drug maker is the first divestment from liquidated fund Novalpina I, now managed by Berkeley Research Group

GP Profile: Verdane looks to step up portfolio deal deployment

Technology investor plans to keep up the pace of its existing direct investments but expects to see more portfolio sellers

AnaCap carves out credit division

New business, Veld Capital, will raise new funds and also deploy via AnaCap's existing credit funds

DPE raises EUR 708m continuation fund for two IT consultancies

German GP’s new vehicle backed by AlpInvest, HarbourVest Partners and Pantheon Ventures

Apposite closes third healthcare fund on GBP 200m

Specialist GP’s Article 8 vehicle tracks six proprietary health impact objectives for investments

Private equity players warn of fundraising "shake-out"

Attendees at IPEM 2022 are bracing for challenging fundraising market to continue into 2023

Adams Street launches private credit platform in Europe

Investor hires James Charalambides from Sixth Street to lead new strategy out of London

LDC expands in East England with hires from Alantra, PwC

Simon Peacock and Mikayil Salahov join sponsor's East Midlands and East of England investment teams

Holland exits Mauritskliniek in sale to PE-backed Corius

Sale of Dutch dermatology group comes nine months after regulator blocked sale to Triton's Bergman

The Bolt-Ons Digest – 16 September 2022

Unquoteтs selection of the latest add-ons with A&M's Ayesa, BC Partners' Valtech, Advent's IRCA, EQT's IVC Evidensia and more

BADideas.fund targets up to EUR 15m for debut vehicle

Early stage investor has seen interest from LPs active in startup space

Auctus sells PharmaLex to trade for EUR 1.28bn

Deal values German pharma services company at 18x EBITDA

Ex-Silverfleet team regroups with DACH-focused GP Sophora

Newly formed GP is raising capital from its own network with a longer-term goal of bringing in institutional investors

HPE targets year-end first close for Growth Fund III

Second stage of the GPтs EUR 300m-EUR 350m fundraise will target US and Southeast Asian LPs

Magnum sells Miranza to PAI-backed Veonet for EUR 250m

Off-market deal values Spanish eye care chain at 14x EBITDA; at least three more ophtha assets in M&A pipeline

Hiro eyes EUR 400 hard-cap for metaverse and gaming fund by year-end

New vehicle has raised the "bulk" of its EUR 300m target and made six deals investments to date