Investments

Q3 Barometer: M&A softens across entire PE spectrum

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

3i plans over GBP1bn in exits with 'better' 2023 in sight

Positive turn to start by Q2; retailer Action valued at GBP 8.6bn, CEO said during results call

Platform boot camp: Buy-and-build holds fast in healthcare sector

Healthcare M&A has held up well in 2022 versus 2021, offering hope in a challenging market

EU's pending foreign subsidies rules put PE deals in the spotlight

M&A from funds backed by Chinese and Middle Eastern investors likely to be the focus of enforcement

Q&A: BVCA's VC committee chair on the current outlook for venture capital

Andrew Williamson discusses the UK VC market and investing in the current macroeconomic environment

Unigrains launches Italian unit with EUR 80m-100m investment plan

Milan-based operation will target agri-food businesses as sister fund FAI nears conclusion

BVCA Summit: PEs take long-term view to ride out uncertainty

Unquote reports on discussions around ESG, continuation funds and PE democratisation at last week’s event

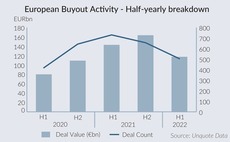

Clearwater Multiples Heatmap: PE deals at record value in Q2 as macro pressure mounts

Sponsor transactions in Europe surged to an all-time high with TMT and the UK leading the way

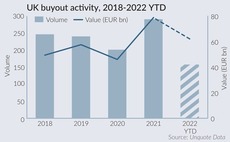

Down but not out: UK PE market confident in spite of sterling, macro concerns

Sponsors prepare to weather the storm and seize opportunities emerging from the crisis

Q&A: Octopus Ventures on consumer investing in times of recession

Partner Rebecca Hunt on the VCтs approach to consumer tech deals and how household savings, pricing down will see businesses through the crisis

Q&A: Syz Capital's Marc Syz on PE fundraising and alternative asset allocations

Alternatives manager discusses topics including US interest in Europe, and the challenges ahead for large-cap buyout strategies

Second-hand: could continuation vehicles become 'SPACs of 2022'?

As the pace of secondary fundraising and deals gains momentum, some challenges start to arise

Nordic Alpha to partner with business angels for greentech deal flow

Danish GP plans to raise money from 20-30 angels, giving them early access to its developing deal pipeline

C'est la rentrée: PEs line up French deals despite adverse market

Local economy managed to stay comparatively strong compared to sluggish global growth and inflationary pressures

Q2 Barometer: Value and volume bifurcation sets in

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

HIG Europe's lower mid-cap strategy eyes succession and carve-out opportunities

Flexible remit allows EUR 2bn vehicle to invest through macroeconomic uncertainty

Buy now, realise later - sponsors go on spending spree amid exit lull

Mounting dry powder sees GPs turn to primary buyouts, P2Ps and carve-outs, although exit pressure remains

Pinova expects final close for Fund 3 before year-end

DACH industrial technology and IT investor has set a EUR 250m target for the vehicle

SwanCap plans October first close for Fund VI

German GP has a EUR 350m target for co-investment vehicle, which will follow the strategy of 2019-vintage predecessor

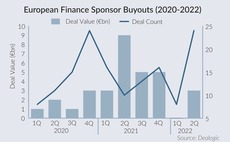

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

Optimism prevails as PEs expect step-up in deal-making – research

Third Bridge's Joshua Maxey speaks to Unquote about the findings of the Mid-market PE Forecast: 2022

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Titanbay launches co-investment programme

Private markets platform plans to make 10-12 deals per year and has a live opportunity in Germany

Clearwater Multiples Heatmap: PE activity holds up amid war, inflation woes

Record levels of dry powder continue to bolster the resilience of the buyout market in Q1 2022