Investments

French sponsor-led deal flow pushes through despite war in Ukraine stalling some auctions

YTD sponsor-led transactions value have so far seen the second highest performing year since 2015

Nest mandates Schroders for PE strategy

Defined contribution workplace pension scheme is seeking exposure to growth and mid-market PE deals

Houlihan Lokey announces promotion in Manchester office

Adviser intends to expand in the region having made nine local hires

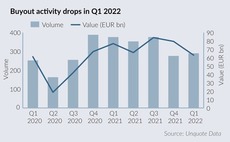

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

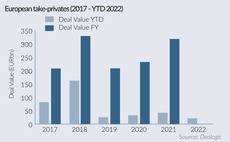

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again

Nordic M&A to withstand mounting macro and geopolitical pressures - panel

Restructurings, take-privates and US interest on the rise, while Q1 2022 buyouts are likely to drag behind

ESG from 'nice to have' to prerequisite for almost all LPs – survey

Adams Street Partnersт 2022 Global Investor Survey gauged LPsт views of 118 LPs globally

Sponsors kick off 2022 with buyout volume down 13% year-on-year

Energy costs, inflation and war in Ukraine cloud deal activity but value holds up with average deal size on the rise

Perwyn hires partner from BGF

Gurinder Sunner joins Perwyn after 10 years at BGF

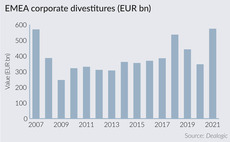

Split the difference – corporate divestitures set records

Firms have taken advantage of favourable conditions for M&A, including cash-rich and ever-bolder PE funds

EMEA M&A surges in 2021

More than 10,500 M&A deals were recorded in 2021, worth a combined USD 1.54trn

Buy-and-build a "super opportunity" for PE in healthcare services – panel

Dermatology, ophthalmology and diagnostic imaging all present attractive consolidation opportunities, panellists said

PE activity reaches EUR 392bn in record-breaking 2021

Q4 may have shown signs of a market slowdown, but 2021 nevertheless stands out as a phenomenal year for PE deployment across Europe

Permira to offload 6.5% stake in Dr Martens

Permira will offload approximately 6.5% stake in Dr Martens via accelerated bookbuild

2022 Preview: Sponsors toast to incredible year, but remain wary of hangover

Many sponsors are anticipating that 2022 could be just as busy as 2021, in spite of mounting headwinds

Q3 Barometer: PE scales new heights

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Unquote Private Equity Podcast: To 12x and beyond

The Clearwater International Multiples Heatmap reveals that average entry multiples broke new records in Q3, on the back of a still-buoyant M&A market

Multiples Heatmap: TMT deals inked in Q3 pass 19x mark

Average entry multiples were again pushed into record territory in Q3 on the back of a still-buoyant M&A market

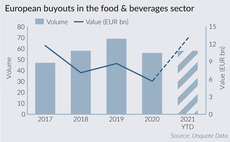

Food and beverage buyouts to reach EUR 13bn in 2021

An average of 44 buyouts totaling EUR 5.1bn were completed in the sector from 2011-2020

ICG to exit Park Holidays in GBP 900m trade sale – report

ICG acquired the caravan holiday park operator in a GBP 362m SBO from Caledonia Investments in 2016

PE funds rework packaging investments around ESG concerns

Can private equity's decades-long love affair with the packaging industry last?

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

Unquote Private Equity Podcast: Leisure sector cleared for take-off

Unquote looks back at how the sector has fared, and speaks with PAI partner GaУЋlle d'Engremont following the ECG deal