Industry

Partners Group's private equity AUM increases 7%

Switzerland-based firm announces тЌ2.37bn new commitments for its private equity strategy

SGG Group buys Augentius in fund admin consolidation play

Transaction would make SGG the fourth largest investor services firm worldwide with $400bn AUM

Private debt picks up steam in Italy

Debt fundraising activity has been vibrant in Italy in recent months with the launch of several vehicles

Allocate 2018: Risk-return for maiden managers and spin-outs

First-time vehicles have enjoyed historically good fundraising conditions over the last two years

British Private Equity Awards: final call to enter

Time is running out to enter the 2018 BPE Awards: entries are due by 4pm on Friday 13 July

SWFs consider reducing PE allocations – survey

Private equity remains among the most popular asset classes in the alternatives space

Capital Dynamics acquires Advanced Capital

Advanced Capital currently manages generalist private equity, real estate and energy funds-of-funds

Quilvest reshuffles management

Alexis Meffre takes over from Stanislas Poniatowski as Quilvest's executive chairperson

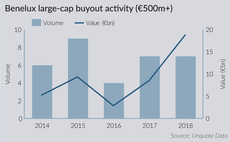

Benelux large-cap activity swells in H1

Aggregate value of deals valued at more than €500m is approaching pre-crisis levels, based on H1 2018 figures

EIF seeks manager for Croatian fund-of-funds

Selected fund managers will be expected to attract private capital to be co-invested

Marlborough opens office in Madrid, hires head of Iberia

PwC's Pedro Manen de Sola-Morales will become managing director and head of Iberia

Lacera to appoint Greenhill as secondaries adviser

Other firms that responded to the RFP include Citigroup, Credit Suisse and Elm Capital

Investec hires HSBC's Burgess

Burgess will focus on origination and execution of private debt services across Europe

Pantheon opens Japan office, hires three

New operation based in Tokyo, Japan will be Pantheon's seventh international office

Achleitner joins Investcorp advisory board

Career academic sits on the advisory board of several other financial institutions

Investors report data concerns for ESG in alternative investments

ESG is a relatively new topic for pension funds in the UK, they are interested in understanding its impact on them, finding out the best practises, adapting to the relevant regulation

Italian PE back in fashion

Despite a drop-off in 2017, total Italian PE value last year is still almost double that of the €4.1bn invested in 2012

Allocate 2018: ESG gains traction with European LPs

Numerous reports and studies have shown that LPs are increasingly concerned about their GPs' environmental, social and governance policies

Draper Esprit to co-invest with Earlybird

Draper Esprit has taken a stake in Earlybird's new Digital West Early Stage Fund VI

Epiris appoints Brent as investment manager

Appointment comes shortly after the newly independent GP promoted Wilson and Wood to partners

HQ Capital signs joint venture with China's Yuanju

Yuanju is a multi-strategy fund manager set up by Chinese state-owned asset manager Everbright

Adcuram hires Brickenkamp and Feldt

Brickenkamp leaves his post at Frankfurt-listed Technotrans to join as head of operations

Bolt-on activity flourishes in CEE region

As the region continues its convergence with the west, a decrease in perceived risk is paving the way for increasing buy-and-build activity

GP Profile: Gimv

Investor relations and corporate communications manager De Leenheer discusses the firm's history of public backing and current strategy