Benelux

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

Kempen reaches EUR 245m final close for second PE fund

Fund has made two co-investments and five partnership deals so far, Kempen's Sven Smeets told Unquote

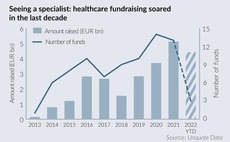

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

The Bolt-Ons Digest – 1 April 2022

NorthEdge's Correla; LDC's Omniplex; QPE's Encore; Cinven's Barentz, Tenzing's Jeffreys Henry, and more

AP Moller, Biogroup among final bidders for Waypoint's Affidea

Final offers for the pan-European outpatient group are expected in a couple of weeks

Ufenau VII closes on EUR 1bn hard-cap

Switzerland-based buy-and-build specialist plans to make 13-15 platform deals from the fund

Azalea holds USD 100m first close for sustainability fund-of-funds

Fund-of-funds will invest in managers focused on ESG and positive environmental and social impact

Trill Impact set for venture fund following Domin appointment

Alex Domin has joined the Stockholm-headquartered impact investor as co-head of ventures

Carlyle to sell Hunkemöller to Parcom, Opportunity

GP will exit majority stake in the Dutch lingerie brand and reinvest as minority shareholder

CVC's Amsterdam IPO move adds impetus to calls for LSE reform

CVC Capital Partnersт reported preference for Amsterdam as a potential home for its shares shows that Londonтs regulatory regime still needs to be far more flexible, several sources said.

Summa co-invests in Castik-backed TBAuctions

Summa joins as shareholder after financing three Nordics-based bolt-ons for the online auctions platform

Adams Street appoints BlackRock's Mioch as Benelux head

Joost Mioch will aim to build the GP's Benelux institutional client and consultant relationships

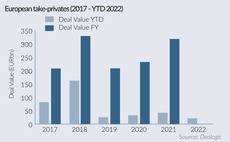

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again

One Peak gears up for fund III

European growth technology firm held a final close for One Peak Growth II in 2020 on EUR 443m

The Bolt-ons Digest – 18 March 2022

KKRтS Biosynth Carbosynth, Agilitasт Cibicom, Apaxтs Graitec, Cairngorm's Verso, Altor's Trioworld, and more

GRO Capital holds EUR 600m final close for Fund III

B2B software-focused fund is more than twice the size of its EUR 255m, 2018-vintage predecessor

BEX Capital raises USD 765m for Fund IV

Secondaries fund-of-funds remains open for no-fee, no-carry investments from NGOs and non-profits

Jeito, INKEF, Forbion lead EUR 80m Series B for Precirix

Precirix last raised a EUR 37m Series A in 2018

Gilde Healthcare closes fourth buyout fund on EUR 517m

Double the size of its predecessor, the new vehicle was oversubscribed and saw nearly all Gildeтs existing LPs investing

Dawn Capital eyes two new funds

Software-focused VC makes early-stage deals; its Opportunities funds back its later-stage portfolio

ESG from 'nice to have' to prerequisite for almost all LPs – survey

Adams Street Partnersт 2022 Global Investor Survey gauged LPsт views of 118 LPs globally

IK taps Lincoln for 2Connect exit

Auction for Dutch cable and connectors manufacturer is expected to launch by Q2 2022

Sponsors kick off 2022 with buyout volume down 13% year-on-year

Energy costs, inflation and war in Ukraine cloud deal activity but value holds up with average deal size on the rise

Integra Partners gears up for EUR 200m-300m global fund

Belgian GP’s new vehicle will invest in international PE funds and co-investments; EUR 120m first close expected in Q1