Benelux

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

EQT acquires LSP, forming EQT Life Sciences

Announcement follows Life Sciences Partners' seven-month, EUR 850m fundraise for LSP VII

3i reaps GBP 146m from Basic-Fit sell-down

Proceeds take 3i's cash return from its investment in Basic-Fit to 4.1x

Unquote Private Equity Podcast: Leisure sector cleared for take-off

Unquote looks back at how the sector has fared, and speaks with PAI partner GaУЋlle d'Engremont following the ECG deal

Victus to come back to market in early 2022

Vehicle will pursue the same strategy as its predecessor, targeting mature agriculture- and food-related businesses

Kempen holds EUR 173m first close for European Private Equity Fund II

New fund is focused on small and lower-mid-market private equity buyouts in Europe

Consumer dealflow rebounds strongly in Q3

More on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

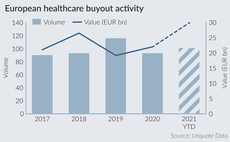

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

IK Partners buys Plastiflex

GP is investing via its EUR 1.2bn Small Cap III fund, which backs companies valued at EUR 15m-150m

Will private equity bank on rising interest rates?

Sponsors want in on banking businesses before greater confidence in asset quality and interest-rate hikes increase valuations

Podcast: In conversation with... Sunaina Sinha, Raymond James | Cebile

The Cebile Capital founder discusses the tie-up with Raymond James, and the key trends at play in the global fundraising and secondaries landscapes

Promus closes space fund on EUR 120m

European Investment Fund committed EUR 40m to the vehicle

White Star holds USD 360m final close for Fund III

Growth technology VC held a final close for its predecessor vehicle in 2018 on USD 180m

Pantheon raises USD 624m for GP-led secondaries programme

Unquote recaps the fundraise and investment strategy with managing partner Paul Ward

Committed Advisors closes CAPF I on EUR 161m

Primaries, early secondaries and co-investment fund is intended to extend the GP's existing strategy

EQT launches EQT Future fund

Fund has a EUR 4bn target and intends to make impact-driven investments in mature companies

LBO France holds EUR 155m final close for Digital Health 2

GP previously raised EUR 70m for SISA, a fund dedicated to healthcare technology

Summa Equity hires three new partners

Christoph Waer, Tim He and Matthias Fink join the firm in three different geographies

Sofinnova holds EUR 472m final close for Capital X

France-headquartered VC will continue to focus on early-stage healthcare investments

One third of LPs plan to increase PE allocation within a year – survey

Schroders' Institutional Investor Study surveyed 750 investors in February and March 2021

2021 European PE exits already exceeding full 2020 tally

GPs are clearly looking to seize the initiative and clear out portfolios amid a general push to ink deals on the buy-side

PAI leans towards US listing in dual-track for Refresco

Paris-headquartered PAI is close to appointing Rothschild to advise it on options

Vendis puts Sylphar on the market

Private equity firms are looking with interest at the asset, one source says