Benelux

BB Capital, Vortex explore KidsKonnect sale

First bids in the Baird-run process are scheduled for this month, sources say

Social concerns increasingly important in European consumer M&A

Ethical supply chains, modern slavery, diversity and inclusion, wage gaps, and health and safety are all "potential liabilities" for M&A sponsors

European ESG market to hit EUR 1.2trn by 2025 – survey

Segment could account for between 27% and 42% of private markets' asset base, up from 15% in 2020, says PwC

Spotlight on Spacs: Fintech fever

A sustained surge in fintech deal-making may well have Spacs to thank

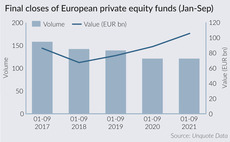

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate

Main Capital raises EUR 1.2bn across two funds

Of the capital raised, Main Foundation I has raised EUR 210m to back smaller software companies

Women in PE continue to earn less than male counterparts – survey

Survey by Heidrick & Struggles found that female principals in the UK are an exception to the trend

ArchiMed invests in Xpress Biologics

Plasmid DNA and protein therapy developer is an investment from the GP's Med II fund

European PE activity could reach EUR 400bn mark in 2021

Aggregate value for 2021 to date is already higher than that seen in any full-year on record, with a full quarter still to play out

Fund financing and ESG: from the impact niche to the mainstream

ESG-linked fund financing facilities are becoming a prominent т and well publicised т tool in the ESG toolbox for GPs and lenders

GP Bullhound closes Fund V on EUR 300m

Technology-focused firm's predecessor vehicle held a final close in June 2019 on EUR 113m

AFB holds EUR 86m first close for second fund

Advent France Biotechnology held a EUR 64.75m final close for its predecessor fund in 2017

European IPOs reach seven-year high in first nine months of 2021

Sponsors have been on the ball when it comes to capitalising on the IPO window this year, according to Dealogic data

Goldman Sachs, Silverfern put Continental Bakeries on market

Goldman Sachs Merchant Banking Division and Silverfern acquired Continental Bakeries in 2016

Capza holds EUR 200m first close for Growth Tech fund

Fund has made four platform investments and backs European digital and technology-based companies

Partners Group closes fourth PE programme on USD 15bn

Programme includes USD 6bn from the GP's fourth direct PE fund, Partners Group Direct Equity 2019

Egeria sells Dutch Bakery to 3i

SBO of the Netherlands-based home-bake and snack products producer ends a four-year holding period

Karmijn Kapitaal appoints van der Maarel as managing partner

Van der Maarel will join the firm on 1 October from NIBC

GP Profile: HPE Growth sets the stage for next fundraise

Manfred Krikke and Tim van Delden on the firm's growth plans, fundraising intentions, and the importance of European digital technology

Bolster Investment Partners holds first close for second fund

Dutch minority investment specialist has surpassed its EUR 200m target at its first close

Podcast: In conversation with… Adam Turtle, Rede Partners

Turtle joins the podcast to discuss the firm's journey over its first decade and the main trends in the European fundraising landscape

Pictet holds USD 350m final close for Technology Fund

GP intends to launch a healthcare- and biotech-focused thematic fund in early 2022

Carlyle revives USD 1.2bn Hunkemoller sale – report

Initial plans to sell the asset were delayed by the pandemic, Reuters reports