Benelux

Bolster backs buyout of Esschert Design

First investment made by Bolster directly from its new fund after spinning out of VLP in late 2017

ArchiMed buys Soest Medical

GP draws equity from its €315m Med II vehicle, which held a final close on its hard-cap in September

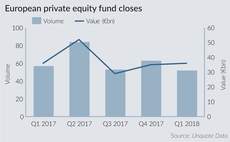

European fundraises off to healthy start in 2018

Number of fund closes and aggregate capital raised in Q1 is roughly on par with the same period last year, but short of the strong start to 2016

Ontario Teachers' chief investment officer Graven Larsen resigns

Graven Larsen joined Ontario Teachers' in February 2016 and led the fund's global investment programme

Waterland sells Attero to 3i Infrastructure

GP sells stake in Dutch waste management company Attero to 3i and DWS

Anchorage, CVC Credit Partners wholly acquire Ideal Standard

Lenders take over from Bain, concluding a restructuring process initiated in 2017

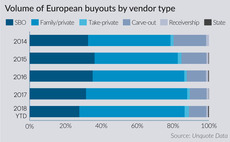

Secondary buyouts hit 10-year low in Q1

Proportion of deals sourced from fellow PE firms has ebbed back to the level last seen in 2007, according to Unquote Data

Egeria's Ilionx bolts on QNH

Following the deal, Ilionx and QNH will create a large ICT service provider with revenues of €100m

Holland and Dolfin sell Esdec to Gilde

Under the vendors' tenure, Esdec has invested in a new R&D facility and international sales activity

Nordian acquires majority stake in Jumpsquare

Jumpsquare plans on expanding inside and outside the region with 10 new parks in the coming year

Value Creation, ABN Amro divest Ion-IP to Proximus

Sale of IT security business brings to an end a 10-year holding period for the vendors

European entry multiples hit new high in 2017 despite Q4 cooldown

Average EBITDA multiple increased to 10.4x in 2017 compared with 10.2x in 2016, according to the latest Clearwater Multiples Heatmap

Carlyle to list Hunkemöller in Q2

Listing on Euronext Amsterdam is expected to take place in May or June at around €1bn EV

Carlyle acquires AkzoNobel's chemicals arm in €10bn deal

Deal for the AkzoNobel division is the largest European PE-backed buyout recorded since 2007

Mega-buyout volumes hit post-crisis Q1 high

Combined with Q4 2017, the past six months have represented the most active consecutive quarters for тЌ1bn-plus buyouts since 2007

Active Capital backs Lumat

GP acquires a significant majority stake in Dutch yarns distributor Lumat in MBO deal

PAI, BCIMC finalise €1.58bn Refresco take-private

97.4% of the company's issued and outstanding shares are tendered at €20 per share

Anterra's food and agriculture tech fund reaches $200m

Anterra extends the fund to capitalise on the global food sector and expands its team

Mentha Capital's Destiny bolts-on Motto Communications

GP injects new equity into Destiny to finance acquisition of Dutch cloud service Motto

Newport Capital backs Cow Hills

VC firm Newport invests in Cow Hills, a Dutch omnichannel point-of-sale software provider

Equistone's sixth fund makes first investment with Boal buyout

Vehicle held a €2.8bn final close this month and writes equity cheques of €25-150m

EIF's push into private capital management

The European Investment Fund is aiming to raise up to тЌ2.1bn in private capital for a new investment platform focused on venture and growth vehicles

Annual Buyout Review: Lower-mid-market momentum lifts dealflow

Unquote's lastest Annual Buyout Review is now available to download for subscribers, offering in-depth statistical analysis of 2017 activity

Gilde Equity Management's Chemogas bolts on Stereo Group

Belgium-based Chemogas has acquired Malaysian sterilisation gases distributor Stereo Group