CEE

Resilient Romania attracting PE

PE investment across all brackets has picked up in Romania this year, and CEE stalwart Mid Europa has just opened an office in the country

LP Profile: Saranac Partners

Established in 2016, Saranac Partners is a multi-family office and financial advisory firm

Tera Ventures et al. in $1.4m seed round for Snackable

Existing and new investors back the Estonian-American startup in its second investment round

LP Profile: Polish Development Fund

The Polish Development Fund's private equity programme has kicked into gear this year, making three fund investments with more in the pipeline. Oscar Geen speaks to Annemarie Dalka about PFR's formation and investment strategy

Advent raises $2bn for tech fund

Fundraise comes shortly after the $17.5bn final close of the GP's flagship product, GPE IX

Anacap raises €1bn for credit fund

Vehicle was launched in November 2018 with a $750m target and raced to a first close on $600m

Unquote Private Equity Podcast: Cloudy with a chance of slowdown

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses H1 stats and looks ahead

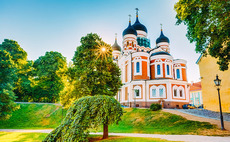

H1 Review: Fundraising and local capital herald CEE buyout revival

Baltic market stands out, recording a higher than usual share of the wider region's dealflow

Secondaries volume up 25% in H1 – research

Setter Capital's latest research reveals a sizeable uptick in private debt deals, though private equity secondaries still dominate the market

Mid Europa opens Bucharest office

New office will be led by Berke Biricik, a principal who joined Mid Europa in 2013

GP-stake sales controversial among LPs

LPs are naturally reticent about their GPs selling stakes in themselves, as emphasis to boost profits from management fees strengthens

Buying and building the modern school

Investments in European private schools and colleges have proven enriching for PE over the past two decades

Innova closes sixth fund on €271m

Innova Capital has held a final close for its sixth fund on €271m.

Genesis buys 11 Entertainment Group

11 Entertainment Group is the eighth investment from Genesis Private Equity Fund III

Battery Ventures leads $33m round for Mews

Battery leads the series-B round, with principal Sanjiv Kalevar joining the board

Baltcap sells Auto24 to Apax-backed Baltic Classifieds

Auto24 marks the first bolt-on since Apax's investment and diversifies the group's portfolio

Actera Group sells Kamil Koç to VC-backed FlixBus

Sale ends a six-year holding period for Actera, which acquired Kamil Koç for approximately €25.5m

Mid Europa-backed Regina Maria buys Somesan Clinic

Addition of Somesan extends Regina Maria's reach to 19 counties and adds 20 outpatient clinics

Q2 Barometer: small-cap boom offsets mid-market lull

Europe records 533 buyout, expansion and early-stage investments over Q2, a nine-quarter low

Nation 1 launches debut fund with a target of €35m

Vehicle plans to invest in Czech startups and small and medium-sized companies with global ambition

Nordic region sees highest entry multiples for sixth quarter running

Q2 edition of the Clearwater International Multiples Heatmap finds a slight cooldown across Europe, though the average multiple still exceeds 10x

Abris buys Global Technical Group

Tenth investment from Abris CEE Mid Market Fund III, a €500m buyout fund that closed in 2017

Innova buys Optiplaza

GP draws capital from Innova 6, a fund with a target of €325m that held a first close on €196m

Alcentra closes European direct lending fund on €5.5bn

Predecessor held a final close on тЌ4.3bn in 2017 and had an average ticket size of around тЌ100m