Nordics

2011-vintage funds: what is still in Nordic portfolios

Unquote and Mergermarket round up a selection of assets still held in 2011-vintage funds managed by Nordic GPs

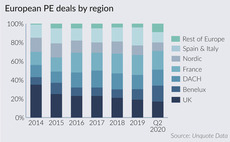

PE exits hit decade low in Q2

Volume of exits by PE players across Europe fell by 43% year-on-year in Q2 2020 as the coronavirus crisis took hold, according to Unquote Data

EV Private Equity acquires 80% stake in Trainor – report

GP has reportedly acquired the company in a deal that values it at NOK 100m

Verdane acquires Caia Cosmetics

GP reportedly paid SEK 200m for a 50% stake, giving the company a valuation of SEK 400m

PE secondaries volume cut by more than half in H1 - survey

Private debt fund secondaries were hit even harder with an 81.8% plunge, Setter says

Nuveen Global Impact Fund holds $150m first close

Fund invests in growth-stage companies in developed and emerging markets, with a focus on resource efficiency

Virtual Briefing: ESG and rebalancing through secondaries

Palico's Woolston Commons, Cambridge Associates' Varco and Unigestion's Newsome discuss whether the current crisis will lead to an ESG rethink

Talde, Oquendo exit Rotecna to Solix-backed Skiold

Rotecna becomes part of Skiold's existing pig business unit and continues to be led by ts management team

Trill Impact acquires Nordomatic from Adelis Equity

Adelis exits the company four years after acquiring a majority stake in it

Capidea sells FlexoPrint to IK Investment-backed Optimum

Danish GP sells the company two years after acquiring it

GP Profile: Priveq Investment

Sweden-based GP completed fundraising for its sixth fund entirely online

VNV Global leads $30m round for Voi Technology

E-scooter operator became profitable for the first time last month and plans to use the proceeds to expand into the UK

Market sentiment improving but dealflow likely to remain bifurcated – Baird

Baird MDs Vinay Ghai and Paul Bail discuss deal-making amid the pandemic and emerging trends for the months ahead

EQT to close ninth buyout fund in Q3

Total investments by the EQT funds in the second quarter amount to тЌ1.3bn

Polaris to acquire and merge four Danish coach operators

Four operators had a combined pro forma revenue of тЌ108m in 2019

Novo Holdings et al. in $20m round for Reapplix

Company will use the proceeds to commercialise its flagship product across the US

Blackstone leads $200m round for Oatly

Oprah Winfrey, Roc Nation, Natalie Portman, and former Starbucks CEO Howard Schultz also take part in the round

EQT sells stake in IFS to TA Associates in €3bn deal

Stake owned by EQT is transferred from EQT VII to its successor funds EQT VIII and EQT IX

Unquote Private Equity Podcast: Fundraising engine stalls

This week, the Unquote Podcast examines the fundraising market amid the challenges of Covid-19

Capgemini to help Nordic Capital implement AI for portfolio companies

GP said one of its portfolio companies already using machine learning to generate additional revenues

Blackstone Life Sciences V closes on $4.6bn

Fund invests in late-stage rounds of established life science companies and emerging businesses

Eir Ventures holds first close on €76m for life sciences fund

VC firm will invest in opportunities in new therapies, medical technology and digital health

HIG Capital launches HIG European Capital Partners III

Fund will invest in buyouts, recapitalisations and carve-outs of both profitable and underperforming businesses

EQT Ventures leads $8m round for Traplight

Play Ventures, Initial Capital and Heartcore Capital also participated in the fundraise