Nordics

Nordic Capital X hits €5bn target in first close - reports

Fund is larger than its predecessor, Nordic Capital IX, which held a final close on тЌ4.3bn in May 2018

Procuritas exits Temporary Space

Acquisition will help trade buyer Algeco to strengthen its position in the Nordic modular space market

EQT to launch Huscompagniet's IPO - report

IPO is expected to be launched by the end of the year or the beginning of 2021 at the latest

EQT, Vaaka Partners sell shares worth €119m in Musti

Shares have been sold to institutional investors for тЌ15.8 a share

Nordic PE exits hit new low in Q2

Volume of exits by PE firms across the Nordic countries in Q2 2020 fell to its lowest point in more than a decade, according to Unquote Data

Tesi, NordicNinja et al. in $54m series-C for Varjo

Tech company has raised $100m since being founded in 2016

Shark Solutions raises funding from Circularity Capital

Company will use the proceeds to develop its manufacturing infrastructure and to expand its product range

Priveq acquires majority stake in Trendhim

Company in 2019 generated revenues of DKK 115m, the equivalent of тЌ15.4m

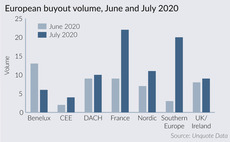

France, southern Europe drive dealflow uptick in July

Buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier

ICG launches second recovery fund

Second vehicle will be larger than its predecessor, which closed on тЌ843m in March 2010

White Park, Navigator Capital carve out Gateway from Gunnebo

Subsidiary has since 2019 generated a loss for Gunnebo

Vitruvian Partners sells Unifaun to Marlin Equity Partners

GP exits the business four years after acquiring a majority stake in it alongside the management

CapMan announces second growth fund; invests in DSP Neural

VC fund has made its first investment in DSP Neural, which raised тЌ5m in a series-A round

Axon launches €150m fourth innovation growth fund

Fondo Axon Innovation Growth IV acquires minority stakes in technology businesses with high-growth potential

CapMan to reorganise service business

GP will launch CapMan Wealth Services, which will combine the services of the disbanded Scala Fund Advisory and JAM Advisors brands

PE-backed Visma acquires Dutch firm Yuki

Deal is Visma's third acquisition in the accountancy software market

Finland's VC industry remains buoyant despite pandemic

Dealflow in the Finnish VC market remained strong in the peak months of the coronavirus outbreak, with local players cautiously optimistic

Paradigm Capital increases IES stake to 57.6%

GP previously owned around 20% of the listed education company

Icelandic company Lucinity raises $6.1m in series-A round

Company has raised $9m in total at the series-A stage, from new and existing investors

Francisco Partners acquires Consignor for €140m

CEO Peter Thomsen will continue in his role and own a 30% stake in the company

DACH buyout market weathers Covid-19 impact, UK and France suffer

Germany emerged as the busiest region in Europe in Q2, albeit with a low volume and aggregate value of deals by historical standards

Programma 102 closes on €100m

VC will launch a new vehicle by the end of the year, with a тЌ100m target, to focus on complementary asset classes

Unquote Private Equity Podcast: Calling tech support

This week, the Unquote Podcast talks all things technology with Intuitus chief commercial officer Adrian Astley Jones

Entreprenörinvest and Innovum in $1.1m round for LocalizeDirect

Company will use the proceeds to launch Gridly, a content management system for multilingual game projects