Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

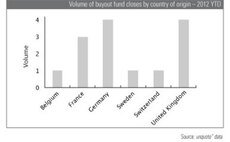

Competition heats up for German fundraising

Deutsche Beteiligungs AG (DBAG) last week closed Germany’s biggest fund since 2007. While the country’s fundraising environment has been paid little attention in recent years, it has seen as many fund closes in 2012 as the UK. John Bakie investigates...

Kelso Place sells Anya Hindmarch stake to Middle East investor

A private Qatari investor group has bought a minority stake in luxury handbag company Anya Hindmarch, allowing Kelso Place Asset Management to exit the business.

21 Investimenti backs Assicom

Italian investor 21 Investimenti has acquired B2B credit collection services firm Assicom.

Star Capital SGR holds first closing

Italian investor Star Capital SGR has held a first closing on more than €70m for Star III, a fund aiming to back Italian SMEs.

Main Capital backs Sofon MBO

Main Capital Partners has acquired a majority stake in Dutch software company Sofon.

Inveready launches €15m technology fund

Spanish investor Inveready has launched a €15m fund to back technology companies.

BC Partners buys Aenova from Bridgepoint

BC Partners has acquired German pharmaceutical manufacturer Aenova Group from Bridgepoint in a transaction understood to be valued at slightly less than €500m.

Alto Partners backs MBI of Virosac

Alto Partners has backed the management buy-in of environmentally-friendly household products company Virosac.

Main Capital holds €12m first close for third fund

Main Capital Partners has held a €12m first close for its Main Capital III fund, launched in September 2011.

United against private equity

PE's public image

DBAG VI hits €700m hard cap

Deutsche Beteiligungs AG (DBAG) has closed its sixth fund at €700m, breaking its target and reaching its hard cap.

3i-backed Element Materials buys MERL

3i portfolio company Element Materials Technology, a materials testing firm, has acquired Materials Engineering Research Laboratory Limited (MERL).

21 Centrale buys Cleor off Azulis

21 Centrale Partners has taken a majority stake in the management buyout of French jewellery retailer Cleor.

NEA et al invest in Silk series-B

New Enterprise Associates (NEA), Atomico and other investors have backed web-based platform Silk in a $1.6m second financing round.

3i secures refinancing for Element Materials Technology

3i-backed Element Materials Technology has secured a $93.25m refinancing package from its existing banking syndicate and two new banks.

Sator and Palladio appeal rejected by courts

Italian private equity houses Palladio and Sator have had their appeal against the proposed merger of Unipol and Fondiaria-SAI rejected by the national courts.

Apax reshuffles senior management team

Ralf Gruss (pictured) has been appointed chief operating officer at Apax Partners following his predecessor's move to become full-time head of the firm's portfolio support group.

Fondo Italiano backs Megadyne

Fondo Italiano di Investimento has invested €20m in Italian belts and pulleys manufacturer Gruppo Megadyne in exchange for a minority stake.

Octopus hires two

Octopus Investments has hired Frederic Lardieg and Simon King.

3i-backed La Sirena completes refinancing

La Sirena, a Spanish frozen foods firm backed by 3i, has completed its refinancing plan.

Intel Capital leads €6.5m series-C for Movea

Intel Capital has led a €6.5m series-C funding round for French technology firm Movea.

3i sells Esmalglass to Investcorp

3i has sold ceramic and enamel producer Esmalglass-Itaca to Investcorp in a deal understood to be worth around €200m.

Endless exits Phoenix Foods to Specialty Powders

Turnaround specialist Endless has sold Phoenix Foods to trade player Specialty Powders in an all-cash transaction.

Spain sees opportunity in disaster

Opportunity in disaster