Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Maguar Capital invests in Bregal-backed STP

Maguar partner Gunther Thies founded STP; partner Arno Poschik was on STP's board during his time at Hg

Triton acquires Geia Food from Credo Partners

Credo exits the company after acquiring a 55% stake in Geia in 2017

Levine Leichtman backs Prime Global

This is the fifth investment made by Levine Leichtman Capital Partners Europe II, which closed on тЌ463m in 2020

Appetite for DACH tech deals continues apace in Q1

Sponsor demand for differentiated IT services and roll-up strategies remains consistent

Cap Grand Ouest 3 holds first close

Fund makes its first investment by acquiring a minority stake in healthcare consultancy Helpévia

KKR sells minority stake in Hensoldt

Leonardo is to buy the 25.1% stake for €606m; KKR will retain an 18% stake in the sensor developer

Clessidra's Botter bolts on Mondodelvino

Combined group expects to reach revenues of €350m in 2020 and further expand its market share

Number of UK club deals reaches three year high – Pinsent Masons

Club deals allow GPs to share risk, buy larger businesses, and reduce the need for high leverage, the law firm said

LeadBlock plans €100m second close for blockchain fund

Fund held a first close on тЌ10m in March this year and will invest at the seed and series-A stages

EQT's Suse sets out IPO plans

Enterprise software platform intends to generate net proceeds of $500m with its Q2 2021 IPO

Eurazeo invests €410m in Aroma-Zone

Following the deal, the founding Vausselin family retains a significant minority stake in the business

MBO exits public relations specialist LLYC

Sale ends a six-year holding period for MBO, which invested €6.35m in the business in exchange for a minority stake

LP Profile: PFR increasingly eyeing funds outside Poland

Polish LP has invested €75m in four private equity firms in recent months, including Apax Partners, PAI Partners and Avallon MBO

DevCo acquires minority stake in Bluefors

GP is deploying equity from DevCo Partners III, which raised тЌ180m at the end of 2019

Egeria acquires NIBC-backed Fletcher Hotels

NIBC backed Fletcher's 2016 MBO; Fletcher plans to grow from 103 to 150 hotels in the coming years

Bowmark promotes four

Firm promotes Cheong and Elliott to partners, Keen to investment director and McRae to investment manager

Prosus, Tencent lead $80m round for Bux

ABN Amro, Citius, Optiver and Endeit take part in the round, alongside previous backers HV Capital and Velocity

Finexx buys Volpini Verpackungen

GP also announces it has increased the volume of its Finexx II fund to €30m

Digital Alpha Fund II closes on $1bn

Fund invests in digital assets, with a focus on next-gen networks, cloud computing and "smart cities"

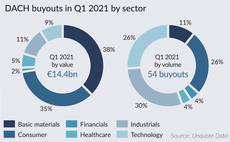

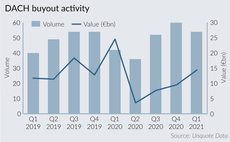

DACH buyouts continue recovery from Q2 2020 low

Both deal volume and value are now back on par with the figures for Q4 2019, prior to the pandemic

KKR leads €100m series-C for Ornikar

Existing investors Idinvest, BPI, Elaia, Brighteye and H14 also took part in the fundraising

Columbus Life Sciences Fund III closes on €120m

Fund invests in early-stage and high-growth opportunities across the life sciences and pharmaceutical industries

Eurazeo to buy Aroma Zone for €700m – report

Company's sale attracts several buyers, including private equity firms Ardian, Bain Capital and CVC, according to reports

Paragon acquires Bregal's Sovendus

Bregal acquired a minority stake in the e-commerce customer reward platform in 2015