Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

IDIA et al. invest €15m in Amarenco

Amarenco also purchases Macquarie Capital's shares in their solar project joint venture

MTIP leads €11m round for Trialbee

MTIP is investing from MTIP Fund II, a vehicle that held a first close in November 2019

Omers Ventures Fund IV closes on $750m

Fund targets growth-orientated, disruptive technology companies based across North America and Europe

BPE backs Dätwyler Sealing Technologies MBO

MBO is the first investment from BPE 4, which held a final close in March 2020 on €135m

Karma, OpenOcean in €2m round for AppGyver

Company will use the fresh capital to accelerate the development of its visual app-builder platform

Omers leads €16.25m series-B for Deliverect

Omers Ventures managing partner Jambu Palaniappan will join the Deliverect board

Elysian III eyes first close in June

LPs in Elysian II include Hamilton Lane, Morgan Stanley and West Yorkshire Pension Fund

Stirling Square hires two

Stirling Square is currently investing from its fourth-generation fund, which closed on тЌ950m

FIEE backs Cremonesi

FIEE invests in Italian companies operating across the energy efficiency and renewable sectors

Partech closes third seed fund of $100m

Partech Entrepreneur III surpasses its original target of $80m

Parcom holds €775m final close for sixth flagship fund

GP took six months to reach its €775m hard-cap target

Index Ventures raises $2bn across two new funds

Index Ventures Growth V, which targets later-stage companies, raises $1.2bn, while Index Ventures X closes on $800m

Silver Investment Partners appoints two partners

Promotion of Matthias Loos and Daniel Schmitz brings the Germany-based GP's partner team to five

MVM invests $14m in MDxHealth

MVM is drawing equity from MVM Fund V, which held a first close on £150m in November 2018

VR Equitypartner-backed Kälte Eckert buys Gartner Keil & Co

Deal is the second add-on for the Germany-based cooling systems and cold storage specialist

Abac Capital exits Metalcaucho to trade

Sale ends a five-year holding period for the GP, which invested in the company via Abac Solutions

Adcuram-backed Poggenpohl files for insolvency

Kitchen furnishings retailer plans to continue its restructuring and will seek new investment

Insight Partners leads $25m series-C round for Templafy

Latest round brings the total amount raised by the Danish software company to around $70m

German GPs weigh up portfolio damage and rescue packages

Nature of Germany's industrials-weighted economy has caused problems for some GPs when it comes to liquidity needs

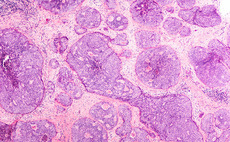

VCs in $80m series-B for Compass Pathways

Compass intends to use the funds to expand upon its lead programme in psilocybin therapy

CRV leads €15m series-A for Factorial

Previous backers Creandum, Point Nine and K Fund also take part in the investment

October starts deployment of Italian direct lending fund

Firm also manages October SME IV, a European Long Term Investment Fund (ELTIF) with a €250-300m target

Inovo launches €40m second fund

Fund will invest in CEE-based tech startups in late-seed and series-A rounds

Felix Capital et al. back €15m series-B for YFood

Foodtech company has increased its revenues by 300% in the past year, according to a statement