Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Elysian sells Wellbeing for 4.5x return

Wellbeing is a provider of radiology and maternity software that manages patient workflow and data

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

KKR invests up to $500m in Kilter

Kilter Finance makes investments from its own balance sheet and is funded by its management team

Seed Capital leads €20m series-B for digital bank Lunar

Company also appoints former Monzo head of product to its board of directors

MMC leads $7m series-A for Ably

MMC Ventures invests from its MMC Greater London Fund, which closed on ТЃ52m in May 2019

Welcome aboard: PE recruitment amid coronavirus

PE-focused recruiters and some GPs themselves are figuring out ways to progress recruitment processes, but challenges remain

Nordic Capital-backed Signicat acquires Connectis

Deal comes a year after Nordic Capital acquired Signicat from Viking Ventures

Riello Investimenti launches €150m debt fund

Fund is larger than its predecessor, Impresa Italia Private Debt I, which raised €70m in 2016

Consortium backs $112.5m round for Collibra

Data software company was valued at $1bn post money in its 2019 round and is now valued at $2.3bn

FVS exits Exor, buys stake in Holdex

FVS invests for minority stakes in Italian companies operating in a wide range of sectors

Main Capital buys majority stake in health software firm Alfa

Netherlands-based GP paid тЌ15-20m for its stake in the company

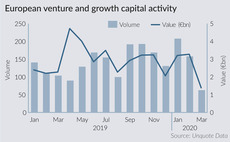

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

CVC closes fifth Asia-Pacific fund on $4.5bn

Both new and returning institutional investors participated in the fundraise for the Asia fund

Quantum-backed Postcon sells subsidiary Pin

GP originally acquired the Germany-based postal service operator from PostNL in 2019

FVS launches €75m second fund

Fund targets minority stakes in companies based across the north-east of Italy, with revenues of €10-200m

Unquote Private Equity Podcast: Covid-19 special

The team gathers for its first remote podcast, discussing how the early stages of the outbreak have disrupted the European PE landscape

C Ventures leads series-A for Agile Robots

AI-backed robot and robotic software developer plans to use the fresh capital to develop its product

Redmile buys additional 12.67% of Redx

Upon completion of the transaction, Redmile will own a total of 110.6 million Redx shares

DBAG-backed Vitronet buys Telewenz

Bolt-on of cable installation market peer is subject to competition authority approval

Bridgepoint buys 28% stake in French asset manager Cyrus

GP invests via its lower-mid-cap fund Bridgepoint Development Capital III, which raised around £600m

Searchlight appoints Crowston as special adviser

Searchlight is currently raising for its third fund, which held a close on $2.75bn in July 2019

Clearwater makes eight hires in the UK

Dyke and Grassby have been promoted to the position of partner and director, respectively

A/O Proptech leads series-B round for Qarnot Computing

Caisse des Dépôts, Engie and Groupe Casino also participate in the round

August promotes Muckle to investment director

Muckle joined August Equity in 2017 and most recently co-led their investment in AirIT