Southern Europe

N+1 makes 3.5x on ZIV sale

N+1 Private Equity has sold its 75% stake in Spanish digital equipment and services provider ZIV Aplicaciones y Tecnología to trade player Crompton Greaves for €150m.

Fondo Italiano provides capital to Hat Holding

Fondo Italiano di Investimento has committed capital to Italian investment company Hat Holding, allowing the firm to shift its focus from club deals to investments from a closed-end fund.

€1.7bn bid for Rottapharm stalls

The bid launched by Clessidra Capital Partners and Avista Capital Partners for Italian drugmaker Rottapharm has ground to a halt due to share governance issues and fundraising difficulties.

The State at play: Italian government jumpstarts flat market

The State at play

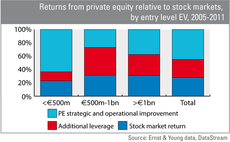

Mid-market leads value creation

Mid-market leads value creation

Vertis backs Blomming

Italian investor Vertis has backed social network e-commerce site Blomming.

AIFMD having little impact on fund marketing

More than half of GPs say the Alternative Investment Fund Managers' Directive (AIFMD) has had little impact on their marketing activities with just a year to go until implementation, according to a survey by IMS Group.

Italian and Russian banks to launch joint venture

Italian banking group Intesa Sanpaolo and Russian bank Gazprombank have signed an agreement to make private equity investments in medium-sized local companies.

Akina holds first close on €173.5m

Akina Partners has held a first close for its fifth fund-of-funds, Euro Choice V, on тЌ173.5m.

Espiga sells Invesa to Animedica

Espiga Capital Gestión has sold Industrial Veterinaria (Invesa), a Spanish pharmaceutical products manufacturer for the veterinary industry, to German firm Animedica Group.

Mercapital makes €100m on Gasmedi sale

Mercapital has sold Spanish respiratory home therapies firm Gasmedi to French gas company Air Liquide for €330m.

Fondo Italiano injects €5m into Antares

Fondo Italiano di Investmento has acquired a minority stake in Italian artificial vision systems producer Antares Vision via a €5m investment in holding company Imago Technologies.

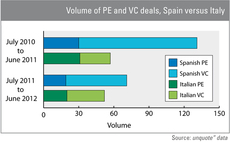

Spain continues to outperform Italy in deal volume

Despite the country's dire economic state, Spanish private equity activity has continued to outpace that of Italy continuously over the past 24 months - although the latter showed more resilience last year.

Coller's sixth fund hits $5.5bn final close

Coller Capital has held a final close for its sixth fund on $5.5bn, exceeding its original $5bn target.

Video: Jonathan Blake advises on fundraising

Video: Jonathan Blake

3i to restructure La Sirena debt

3i has asked lenders to restructure a partially amortised loan worth €90m for Spanish frozen foods retailer La Sirena.

Q&A: Taylor Wessing on tech investment

Q&A: Taylor Wessing

Permira sells Valentino to Qatari investors

Permira has sold Valentino Fashion Group to Mayhoola for Investments, a vehicle backed by a Qatari private investor group, in a deal believed to be valued at around €700m.

Fondo Italiano invests €10m in EMARC

Fondo Italiano di Investimento has injected €10m into italian industrial group EMARC in exchange for a minority stake.

Idinvest leads €6m round for Social Point

Idinvest has led a €6m series-B financing round for online games producer Social Point, alongside BBVA and Nauta Capital.

Magnum buys Geriatros

Magnum Capital has acquired Spanish care services provider Geriatros.

N+1 and Mercapital merge

Spanish venture capital firms N+1 Private Equity and Mercapital have merged to form N+1 Mercapital. The new investment firm will manage €1.7bn, making it the largest in Spain.

Filas injects €1.2m into iLike.Tv

Italian regional investor Filas has injected €1.2m into online streaming and social media platform iLike.Tv.

Buyers consider Permira-backed Valentino

A sovereign wealth fund is to make an offer for Italian fashion brand Valentino Fashion Group, owned by Permira.