Southern Europe

Foreign GPs boost Nordic buyout figures

Two months into the second half of 2012 and buyout statistics for the Nordics send out mixed signals.

Active Venture Partners holds final close on €54m

Active Venture Partners has closed its second technology fund on €54m.

Top 5 exits of 2012 so far

Top 5 exits of 2012

I2C backs Keramat with €600,000

Government-backed Galician venture capital fund I2C has injected €600,000 into ceramic biomaterials firm Keramat.

Voting ends today: British Private Equity Awards 2012

British Private Equity Awards

Seat Pagine Gialle in €1.3bn debt-for-equity swap

Seat Pagine Gialle, the Italian directories firm backed by CVC Capital Partners, Permira and Investitori Associati, has announced the conversion of a tranche of bonds to equity.

Would the real CEE please stand up?

Confusion over CEE stats

PE firms lose Fondiaria to Italian inner circle

PE firms lose Fondiaria

Flood of businesses for sale expected

Sale flood expected

Olympic legacy to accelerate UK venture

Accelerating European venture

Italian association introduces graduates to the industry

Italian private equity and venture capital association AIFI is to hold a conference in October to introduce young people to the industry.

21 Investimenti backs Assicom

Italian investor 21 Investimenti has acquired B2B credit collection services firm Assicom.

Star Capital SGR holds first closing

Italian investor Star Capital SGR has held a first closing on more than €70m for Star III, a fund aiming to back Italian SMEs.

Inveready launches €15m technology fund

Spanish investor Inveready has launched a €15m fund to back technology companies.

Alto Partners backs MBI of Virosac

Alto Partners has backed the management buy-in of environmentally-friendly household products company Virosac.

Sator and Palladio appeal rejected by courts

Italian private equity houses Palladio and Sator have had their appeal against the proposed merger of Unipol and Fondiaria-SAI rejected by the national courts.

Fondo Italiano backs Megadyne

Fondo Italiano di Investimento has invested €20m in Italian belts and pulleys manufacturer Gruppo Megadyne in exchange for a minority stake.

3i-backed La Sirena completes refinancing

La Sirena, a Spanish frozen foods firm backed by 3i, has completed its refinancing plan.

3i sells Esmalglass to Investcorp

3i has sold ceramic and enamel producer Esmalglass-Itaca to Investcorp in a deal understood to be worth around €200m.

Spain sees opportunity in disaster

Opportunity in disaster

Summit Partners raises $520m credit fund

Summit Partners has raised a $520m credit fund for middle-market companies, far surpassing its original $300m target.

Spain's CDTI to launch two venture vehicles

Spain’s Centre for the Development of Industrial Technology (CDTI) will soon launch two venture capital vehicles with capital commitments totalling €150m, according to reports in the Spanish press.

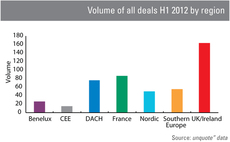

UK dominant as European deal activity stumbles

The UK has reasserted its dominance as a European private equity market in 2012, racing ahead of the competition, according to figures from unquoteт data.

Video: Natural attrition of GP relationships to accelerate – Capital Dynamics' Katharina Lichtner

Video: Capital Dynamicsт Katharina Lichtner