Southern Europe

European ESG market to hit EUR 1.2trn by 2025 – survey

Segment could account for between 27% and 42% of private markets' asset base, up from 15% in 2020, says PwC

RGI sale by Corsair Capital draws CVC, Nextalia interest

Carlyle, Investindustrial and TA Associates are also among the sponsors showing initial interest

Spotlight on Spacs: Fintech fever

A sustained surge in fintech deal-making may well have Spacs to thank

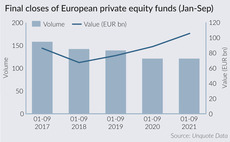

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate

Comdata sponsor Carlyle Group taps Citi to prepare auction

Carlyle acquired Comdata from Altair in December 2015, in a deal valuing Comdata at 4x EBITDA

Women in PE continue to earn less than male counterparts – survey

Survey by Heidrick & Struggles found that female principals in the UK are an exception to the trend

San Giorgio in sale talks with Ergon, reviews valuation expectations

Owning family is looking to sell a minority stake in San Giorgio via a capital increase

European PE activity could reach EUR 400bn mark in 2021

Aggregate value for 2021 to date is already higher than that seen in any full-year on record, with a full quarter still to play out

Five Seasons closes second fund on EUR 180m

Food-technology-focused VC held a final close for its debut fund on EUR 77m in 2019

Fund financing and ESG: from the impact niche to the mainstream

ESG-linked fund financing facilities are becoming a prominent т and well publicised т tool in the ESG toolbox for GPs and lenders

Bregal buys Safety21, marking first deal in Italy

GP plans to assist the traffic monitoring software with its international expansion

Kyma Partners holds EUR 100m first close for debut fund

Italy-headquartered GP focuses on the digitalisation of Italian SMEs and is targeting EUR 130m

GP Bullhound closes Fund V on EUR 300m

Technology-focused firm's predecessor vehicle held a final close in June 2019 on EUR 113m

AFB holds EUR 86m first close for second fund

Advent France Biotechnology held a EUR 64.75m final close for its predecessor fund in 2017

European IPOs reach seven-year high in first nine months of 2021

Sponsors have been on the ball when it comes to capitalising on the IPO window this year, according to Dealogic data

Mutares set for capital increase to boost deal-making

Listed special situations investor aims to raise EUR 100m to back its future growth and investments

Bain-led consortium to acquire ITP Aero in EUR 1.7bn deal

GP teamed up with Basque and Spanish partners following political scrutiny of the sale process

GP Profile: Gyrus looks to next steps after debut pandemic fundraise

Co-founder Guy Semmens discusses the GP's first-time fundraise, its deal pipeline, and the lead-up to its next fund

La Doria confirms take-private talks with Investindustrial

La Doria has a market cap of EUR 600m and posted revenues of EUR 423.8m in H1 2021

Ambienta makes six senior hires

Sustainability-focused GP has made appointments in areas including sustainability and strategy

Apax Digital Fund II holds USD 1.75bn final close

Technology-focused fund took less than four months to reach its hard-cap, Apax said in a statement

Kibo Ventures forms continuation vehicle for debut fund

HarbourVest is backing the restructuring of the 2012-vintage fund, which has reported 25% IRR

Capza holds EUR 200m first close for Growth Tech fund

Fund has made four platform investments and backs European digital and technology-based companies