Southern Europe

Green Arrow acquires Seven

GP is acquiring the stake from the Di Stasio family, which controls the Italian backpacks maker

Talde acquires Tegor Group

Bilbao-based GP takes a majority stake in the Spanish cosmetic nutrition products supplier

VC-backed ForceManager buys Sellf

After the acquisition, mobile CRM developer ForceManager will employ around 150 people

AGIC sells Gimatic for €370m

Industrial automation supplier Gimatic is sold to Barnes Group, an industrial manufacturer

Northleaf nets $2.2bn for global PE programme

Canadian private markets investor closes its latest secondaries vehicle on $800m

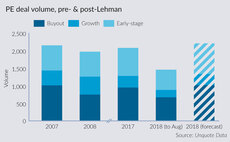

Then and now: European private equity's post-Lehman decade

European PE came to a virtual standstill 10 years ago, but figures show the asset class has all but recovered its pre-crisis appeal

Talde buys Acoustic & Insulation Techniques

Company intends to use the fresh capital to open a new production plant in the US in 2019

Crest Capital backs Global Fire Equipment

First investment made by the Portuguese GP with its €97m debut fund Crest Capital I

Abac acquires Motocard

GP deploys capital from its Abac Solutions I fund, which held a €320m final close in May 2016

Unigrains' Fondo Agroalimentare Italiano backs Agrimola

Banca Popolare dell'Emilia-Romagna and Mediocredito Italiano provide a debt package for the deal

360 Capital, P101 exit Musement

Company will be managed as an independent business unit within TUI Destination Experiences

Corpfin buys Dimoldura Group

Corpfin draws capital from its €255m fourth buyout fund that held a final close in 2015

Nexxus, Capzanine acquire stake in Spanish medical group

Group's founders, Manuel and Jorge Fernandez, will retain the majority stake in the business

IK-backed Colisée bolts on STS Grup

Colisée raised a new term loan of €120m in order to increase its financial capabilities

ProA Capital launches third buyout fund

Vehicle is larger than its predecessor, ProA Capital Iberian Buyout Fund II, launched in June 2014

Carlyle buys stake in Investindustrial-backed design group

GPs will own equal stakes in the new group and invest alongside the founders of B&B Italia and Flos

Arcadia buys Castello Italia

Chemical Project Holding, which acquired Castello in 2000, retained the remaining 25% stake

Capvis holds final close on €1.2bn

Significant increase on Capvis IV, which launched with a €600m target in February 2013

Aretex Capital Partners acquires Building Energy

Announcement marks the recently formed GP's third investment from its inaugural fund

Franklin Templeton, Asia Alternatives to launch fund-of-funds

Joint venture, called Franklin Templeton Private Equity (FTPE), will be headed by Arthur Wang

Private equity in the age of digitalisation

Unquote and Taylor Wessing bring together leading tech-focused PE practitioners to discuss modern challenges and opportunities

Inveready leads €4.5m round for ProntoPiso

Sabadell Venture Capital and several private investors also take part in the financing

Talde backs Burdinberri

Company's management team will continue to lead the business in this new phase of expansion

Green Arrow holds €230.6m final close for third buyout fund

Fund inherited Quadrivio's third vehicle's portfolio after the GP was acquired by Green Arrow in 2017