UK / Ireland

Mobeus hires three in growth team

Investment director Joe Krancki joins from Frog Capital, where he was a partner

Q1 Barometer: Total European deal value reaches new decade high

The latest Unquote Private Equity Barometer, produced in association with Aberdeen Standard Investments, is now available to download

Astorg, Bridgepoint buy Fenergo from Insight Partners

Media report values the business at $1.16bn, with the two GPs buying their stake for $600m

Endless's Enact carves out Jost's Edbro

Hydraulic cylinder producer is the third deal of 2021 from the GP's Enact strategy

Exponent acquires Gü

Exponent said in a statement that the dessert producer has international expansion potential

Top Tier Capital closes European fund on €260m

Fund makes primary and secondary investments in venture capital funds and co-investments in select portfolio companies

Warburg Pincus, Macquarie invest in Premier Technical Services

Macquarie Capital acquired PTSG in a take-private in 2019 and is reinvesting in the new buyout

KKR buys majority stake in ERM from Omers, AIMCo

Omers Private Equity backed the sustainability consultancy in 2015; the exit is valued at $2.85bn

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Sanne rejects Cinven's £1.3bn offer

Cinven's proposal amounts to 830 pence per share, representing a 37.6% premium to Sanne's shares price of 603 pence

Livingbridge reaches £1.2bn mark for seventh fund

Partner Fiona Dane recaps the fundraising effort, which is double the size of its predecessor, with Harriet Matthews

Apposite Capital announces new appointments

Talent and human capital director and investment manager are among the new appointments at the UK-based GP

Abingworth Clinical Co-Development Fund 2 closes on $582m

ACCD 2 finances the development of late-stage clinical programmes of pharmaceutical and biotechnology companies

Bain Capital buys Valeo from CapVest

Bain intends to further boost the company's growth both organically and through acquisitions

Investec provides ESG-linked NAV facility for Bluewater

Facility is related to the portfolio of Bluewater Energy Fund I, which closed in 2013 on $861m

LDC backs PR firm Headland

LDC has history investing in PR consultancies; the GP backed Blue Rubicon from 2012 to 2015

Debt funds celebrate strong dealflow following Covid stress-test

Direct lenders now see shift away from refinancings and towards new deals, including 2020 processes coming back to life

YielCo holds closes for PE and co-investment funds

YielCo Special Situations Europe II is targeting тЌ300m; YielCo Defensive Investments targets тЌ150m

Sovereign invests in AquaQ Analytics

GP is currently on the road for Sovereign Capital V with a ТЃ450-500m target, as reported by Unquote

Park Square Capital Partners IV closes on €1.8bn

Fund invests in primary and secondary subordinated debt in both performing credit and dislocated debt

NeoGenomics buys VC-backed Inivata for $390m

Inivata will become a separate business division alongside NeoGenomics' clinical, pharma and informatics units

Inflexion sells Reed & Mackay to trade

Sale of the corporate travel business to US-based TripActions is the GP's fifth exit in six months

Perwyn opens Paris office, eyes more investment on the continent

Firm has already made two investments in France: Isla Delice in 2018 and Keobiz in 2020

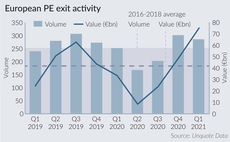

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers