UK / Ireland

Quantifying PE's appetite for recurring revenue models

Buyouts in sectors where recurring revenue models are predominant went from 8% of European volume in 2010 to 22% in 2021 to date

LDC buys Sohonet from FPE Capital

With LDC's support, the company intends to boost its international growth and explore complementary acquisitions

BGF-backed TIG bolts on ThirdSpace

Acquisition of the cybersecurity and identity firm is backed by BGF and Santander Growth Capital

BGF invests in Leeds company Northern Building Plastics

GP's backing will help the company expand its service, delivery capability, and product range

BlackRock joins $100m series-C funding for Exscientia

Company plans to use the financing to expand its portfolio of drugs and grow its artificial intelligence capabilities

Consortium in $400m series-C for Hopin

Virtual event software was valued at $2.1bn at the time of its $125m round in November 2020

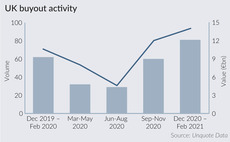

How UK PE buyouts soared ahead of 2021 Budget

Amount of dealflow in the past three months is significantly higher than in previous December-February periods

Phoenix invests in Setfords Law; BGF exits

Phoenix will acquire a majority stake in the legal network; BGF invested £3.75m in Setfords in 2016

Sofinnova Crossover Fund closes on €445m

Fund focuses on investments in later-stage biopharma and medtech companies that need capital to scale up

August Equity sells PCS to BC Partners' VetPartners

Sale ends a six-year holding period for August, which invested in the company via its £200m August Equity Partners III fund

Bowmark, LDC sell Node4 to Providence

IT business was expected to fetch a valuation in excess of £300m, based on a 15x multiple

Biotech market provides dose of optimism

In the past year, the biotech market has seen buoyant activity, reaching record levels of investments

Synova sells Tonic Games to Epic, nets 200% IRR

Exit closely follows that of Fairstone Group to TA, which resulted in a 4.5x return

CBPE invests in Mindera

Software systems developer is the GP's first investment from its £561m CBPE X vehicle

Beyond Black holds first close for Pledge Fund I

Following the €20m first close, the Berlin-based VC aims to launch a larger cleantech-focused fund

NorthEdge invests in Distology

GP is investing from its £120m SME Fund, which held a final close in July 2018

Inflexion invests in DR&P Group

GP is acquiring a majority stake in the insurance broker via Inflexion Enterprise Fund V

Download the March 2021 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers

Virgin Wines floats in £110m IPO, Connection reaps 7.6x

Mobeus remains invested in the business, while Connection makes a full exit

LDC backs WCCTV with £30m investment

Company plans to use the fresh capital to further accelerate its international expansion and launch new products

LDC invests in Phoenix Datacom

As part of the transaction, Phoenix Datacom extends its banking facilities with Lloyds Bank

Platinum-backed Cision buys Brandwatch for $450m

Brandwatch raised around $65m over three funding rounds from VCs including Partech and Nauta

Inflexion secures majority stake in Pangaea Laboratories

Beauty product developer owns the Medik8 brand, which generated revenues of £18.9m in 2020

No need to panic about high dry powder as PE market comes roaring back, says Bain

Appetite remains high for deal-making and exits, according to Bain & Company’s 2021 Global Private Equity Report