UK / Ireland

Private equity seeks solutions to uncertainty as coronavirus derails buyouts

Dealmakers are trying to keep the buyout show on the road as the coronavirus crisis overtakes the European market

Bowmark Capital invests in Focus Group

Additional funding of around £150m will be made available for the company's acquisition plan

Mobeus leads £3.5m round for Bella & Duke

Mobeus investment executive Joshua Henshaw will join the board of Bella & Duke

Coronavirus outbreak could lead to fundraising logjam, PE players warn

Industry participants contacted by Unquote expect negative ramifications for fundraising as well as deal-making activity

Failed auctions accelerate as sellers' market peaks – research

UK accounts for 54% of failed auctions since 2015, according to the Investec research

Advent-backed Rubix acquires Barlotti, Walter Gondrom

Unquote understands the acquisitions were not backed by fresh equity from the firm

TA- and Hg-backed Access acquires JMI-backed CoreHR

Alongside JMI Services, US-based private equity firm JMI Equity invested in CoreHR in January 2016

Limerstone buys Patricia Whites and Country Cousins for £14m

Grant Thornton was engaged to explore an auction process for the assets in December 2019

BGF and Coutts announce UK Enterprise Fund

Specific initiatives and programmes will be put in place to support female-led businesses

LDC acquires stake in healthcare company Ashtons

Founder Laurence Sprey will exit the company, with LDC backing the management team

Frontline closes FrontlineX fund on $80m

Frontlinex has already made investment in TripActions’ series-B and People.AI’s $100m series-C

Legal & General promotes Fitzpatrick to managing director

Fitzpatrick is expected to explore ways to deploy capital and enhance returns across alternatives

CVC Credit finances Sun European’s WesCom acquisition

CVC’s European Private Debt business will provide a senior term loan and acquisition facilities

Draper Esprit hires investment director in London

Hornung will focus on consumer internet, financial services and online marketplaces

Trustbridge Partners et al. in $41m series-B for FiveAI

Existing investors including Lakestar also back the UK-based autonomous driving startup

FPE-backed Optimity acquires Pebble IT

Optimity makes the acquisition using a mix of new equity from FPE and debt from Clydesdale

BGF exits Vysiion for 3x return

Founded in 1971, Wiltshire-based Vysiion offers products and services surrounding IT infrastructure

Oakley to acquire Globe-Trotter

Oakley intends to strengthen Globe-Trotter’s position in the luxury travel luggage market

Inverleith acquires Montane

Firm is currently investing from Inverleith Limited Partnership fund, which closed on €60m in 2018

Huntsworth board accepts £524m offer from CD&R

Takeover offer implies an entry multiple of 10.8x adjusted EBITDA of £48.4m

Podcast: In conversation with... Joe Moynihan, Jersey Finance

The inaugural episode in our new podcast series sees Joe Moynihan stop by to discuss how Jersey is positioned as a domicile for PE funds post-Brexit

Livingbridge appoints four in investment team

Announcement follows the recent appointment of two partners and seven investment professionals

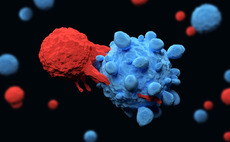

GA leads $130m series-B for Immunocore

Five existing investors, including Eli Lilly and RTW Investments, take part in the round

EMK acquires Trustonic

GP is currently investing from its debut buyout fund, which closed on £575m in May 2017