Healthcare

GP Profile: Equistone banks on experience to ride through the next cycle

As the firm contemplates future fundraising, Unquote speaks to partner Tim Swales about the GPтs current outlook

Ardian exits Unither to GIC, IK-led consortium

Existing investors Keensight and Parquest to remain in share capital alongside company's management

Unigestion holds first close for Direct III, eyes EUR 1bn target

GP is continuing concurrent fundraises for vehicles focused on climate impact and emerging managers.

Nordic Capital holds final close for Fund XI on EUR 9bn

Fund is nearly 50% larger than its predecessor and closed after nine months of roadshow

Platform boot camp: Buy-and-build holds fast in healthcare sector

Healthcare M&A has held up well in 2022 versus 2021, offering hope in a challenging market

Houlihan Lokey poaches Hepberger to bolster healthcare team

Rainer Hepberger spent nine years at William Blair and two at Raymond James; brings expertise in medtech

Trilantic-backed Oberberg's auction delayed on market malaise

Factors including valuation discrepancies and debt markets may have slowed the psychiatry clinic's sale

H2 Equity's Optegra sale advances to second round

UK-based ophthalmology business has received NBOs implying an EBITDA multiple of more than 15x

Palatine exits Veincentre in SBO to CBPE

Sale of varicose vein treatment clinic chain is the second exit from 2016-vintage impact fund

The Bolt-Ons Digest – 17 October 2022

Unquoteтs selection of the latest add-ons with Equistone's Ligentia, Bridgepoint's Infinigate, Ambientaтs Namirial and more

Qualium bets on high dry powder level to sustain exit valuations

Mid-cap sponsor nears EUR 500m Fund III target with closing expected before year-end, source says

Andera Life Sciences closes sixth fund above target on EUR 456m

Fundraising comes as LPs look for more diversification; VC fund will deploy EUR 5m-15m tickets in therapeutics, medtech

Graphite weighs Compass Fostering exit advised by Harris Williams

Sale unlikely to launch soon given downturn in children fostering services space

Financière Arbevel gears up for new life sciences fund first close

With EUR 100m target second vehicle seeks to attract regional entities of French banks

Agilitas bolsters team with two new hires in London

Philip Krinks, Arnaud Moreels join pan-European sponsorтs ESG and investment teams

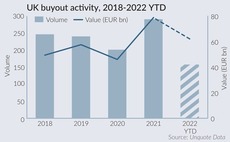

Down but not out: UK PE market confident in spite of sterling, macro concerns

Sponsors prepare to weather the storm and seize opportunities emerging from the crisis

Novalpina fund exits Laboratoire XO to Stanley Capital

French drug maker is the first divestment from liquidated fund Novalpina I, now managed by Berkeley Research Group

Blisce eyes USD 250m final close for Fund II by Q1 2023

French VC has received USD 220m in commitments for Europe and US-focused growth vehicle

Apposite closes third healthcare fund on GBP 200m

Specialist GP’s Article 8 vehicle tracks six proprietary health impact objectives for investments

Cathay to close latest small-cap fund in early 2023 on up to EUR 350m

Vehicle will target companies with EVs of EUR 40m-EUR 100m and has so far made six acquisitions

GENUI explores Labor Team W exit just a year after labs group buyout

Rothschild hired to assess options after Swiss asset attracted inbound interest from trade

Bridgepoint reviews options for Diaverum advised by Citi

Strategic review follows pulled IPO attempt for Swedish dialysis company in 2020

Holland exits Mauritskliniek in sale to PE-backed Corius

Sale of Dutch dermatology group comes nine months after regulator blocked sale to Triton's Bergman

The Bolt-Ons Digest – 16 September 2022

Unquoteтs selection of the latest add-ons with A&M's Ayesa, BC Partners' Valtech, Advent's IRCA, EQT's IVC Evidensia and more