DACH fundraising in rude health

As dealflow continues to rise, fundraising remained buoyant in the DACH region in H1 2017. But with average entry multiples rising, can 2017 dealflow keep pace with a boisterous 2016? Gareth Morgan reports

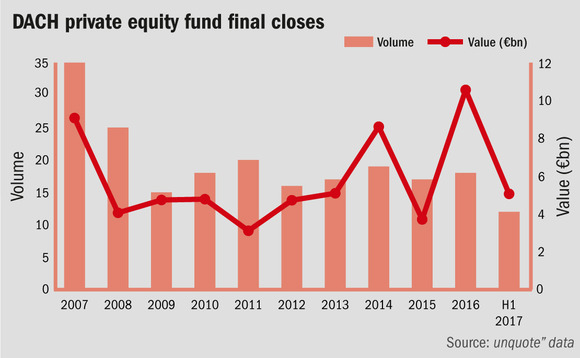

Private equity fundraising in the DACH region, as in the rest of Europe, is seeing continued strength, raising the most capital last year since the global financial crisis.

A total of €10.6bn was raised by 18 funds managed in the DACH region that held a final close in 2016. This is more than double 2015's tally, and the most raised over a 12-month period on record. H1 2017 has seen a continuation of this buoyancy, with €5.1bn secured by 12 funds holding a final close in the six months to July.

LPs are generally short on DACH exposure, in that their portfolios are structurally underweight relative to the country's GDP" – Mounir Guen, MVision Private Equity Advisors

Drivers behind strong private equity fundraising globally also apply to the DACH region. As Europe's largest economy, LPs are eager to gain exposure to Germany, which has not been easy to access historically, and they are keen to deploy capital in funds that have access to the region.

"LPs are generally short on DACH exposure, in that their portfolios are structurally underweight relative to the country's GDP," says Mounir Guen, CEO of MVision Private Equity Advisors. "Statistically, the volume of potential opportunities in Germany is very large, but as an investor looking to capture the market, access can be difficult as there's a limited domestic head-count of GPs."

For fund managers active in the region, this demand facilitates quick fundraising for products with access to DACH dealflow. This is increasingly the case recently, with political uncertainty around the UK's decision to leave the EU causing some institutional investors to rethink their allocation to the country.

Deal activity ramping up

The increasing interest in DACH is reflected in the significant jump in deal volume in 2016, a year-on-year increase of 44%, as reported in the unquote" 2017 Annual Buyout Review. The DACH region also saw the second highest increase in year-on-year deal value across Europe in 2016, with €25.8bn deployed in buyout deals, a jump of 39.9% from 2015's total.

A significant statistic highlighted in the 2017 Annual Buyout Review is in the sourcing of deals from family and private vendors, which jumped to 55 in 2016 from 37 in 2015, and increased 268% in terms of value year-on-year. This growth illustrates the increasing openness of entrepreneurs to financial sponsors, but market participants continue to view the DACH market as underperforming relative to its potential.

There is still a perception that [DACH] owners tend to sell to industrials rather than financial players. The dealflow is good, but underweight given the actual opportunity set and size of the economy" – Kathleen Bacon, HarbourVest Partners

Kathleen Bacon, managing director at HarbourVest Partners, says: "DACH is a great market as far as well-rounded businesses, international products and international consumers are concerned. But the biggest issue with this market is unlocking its opportunities. There is still a perception that owners tend to sell to industrials rather than financial players. The dealflow is good, but underweight given the actual opportunity set and size of the economy."

Looking in depth at unquote" data's deal information for the region reveals a clear distinction between the sources of capital across size bands. Taking average DACH-region deal size for GPs over the last five years, DACH-based managers are significantly more active than their pan-European counterparts at the lower end of the spectrum, accounting for around 70% of GPs with an average deal value of less than €50m in the region. This percentage falls to around 40% of GPs with an average deal size between €50-250m, and 10% of GPs with an average deal size of more than €250m.

This pattern is in part due to the fact that lower mid-market and small cap GPs typically operate very locally, relying on their local network for sourcing and execution.

H1 2017

The first six months of 2017 have seen 51 buyout deals in the region, with an aggregate deal value of €6.8bn, according to unquote" data. The same period in 2016 saw €11.1bn deployed through 49 buyout transactions, and so 2017 is so far struggling to keep pace with what was a record-breaking year.

This could be a function of the elevated pricing seen in the market. Clearwater International's Multiples Heatmap, published in association with unquote", saw average entry multiples in the DACH region at 11.2x EBITDA in Q1 2017, and 11.1x in Q2, significantly above the region's long-term average of 9.8x. In this environment, many GPs are becoming wary when it comes to deploying capital, and this appears to be confirmed by the fall in deal value.

2017's Annual Buyout Review noted the pick-up in deals during H2 2016, which took the year to record-breaking levels of buyout activity. With fundraising in the region over H1 2017 continuing at the strength seen in 2016, it will be interesting to see if H2 deal activity picks up where 2016 left off.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater