DACH unquote

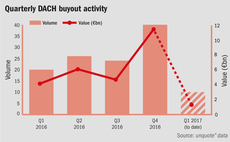

Quiet start to 2017 for DACH buyouts following Q4 flurry

Number of large German deals saw the DACH region outpace its European neighbours at the end of 2016, in terms of aggregate value

Ardian sells Frostkrone to Emeram

French GP exits its stake in the German forzen foods manufacturer after a four-year holding period

PE-backed Rad-x bolts on Acura

Deal marks the second bolt-on for the business, following the acquisition of Swiss diagnostic imaging provider IRD

Cinven's CeramTec acquires UK Electro-Ceramics from Morgan

£47m deal for the technical ceramics business marks the second bolt-on for CeramTec under the GP's tenure

Mosaic and Ribbit lead €5.5m series-A for Bonify

Two VCs join existing backers Index Ventures, DN Capital and HW Capital

BioMedPartners hits CHF 75m first close for third fund

Healthcare-focused GP expects to reach a final close by early 2018

Altor’s Norican bolts on Auctus-backed LMCS

Deal sees Auctus fully exit its portfolio company after a two-year ownership period

Project A closes second fund on €140m

Figure raised by the VC for its second vehicle is 75% higher than the total raised for its maiden fund

Partners Group holds €1.5bn first close for direct investment fund

Buyout firm acquired French pharmaceutical group Cerba HealthCare for €1.8bn from PAI Partners earlier this year

DACH GPs hunt for value following fundraising bonanza

With strong fundraising activity in the region, GPs must now find value in a challenging market

HQ Equita acquires Well Plus Trade

Buyout house secures a majority stake in the German producer of protein-based sports nutrition

KKR successful in GFK share purchase

Private equity giant will now have a say in trying to turn the German market research business around

AGIC Capital hits final close on $1bn for debut fund

Maiden Sino-European buyout fund started fundraising in March 2015

Forbion, Seroba co-lead €29m series-B for Prexton

Backers include existing investors Merck Ventures, Ysios Capital and Sunstone Capital

Unigestion acquires Akina in $6bn AUM merger

Merged group will have $6bn in assets under management and will trade under the Unigestion brand

Capvis acquires Wer Liefert Was from Paragon Partners

Deal marks fourth investment in Germany for the GP's 2013-vintage vehicle Capvis Equity IV

Bregal buys Swiss watches and jewellery retailer Embassy

Deal marks the sixth investment overall and the second in Switzerland for the GP

Deal in Focus: Hannover Finanz backs PWK’s MBO

An in-depth look at the GP’s acquisition of the German auto parts producer market

Akina closes Euro Choice VI on €410m

Fund previously held interim closes on €180m and more than €200m before the final close

KKR Capstone hires Benkert as head of Europe

Former McKinsey executive will boost KKR’s investment activity in Europe

Fidura sells Webfactory via trade sale

GP sells its stake in the German software business after 10-year holding period

KPN leads €5m seires-B for Personal MedSystems

Backers include German lender NRW Bank, Seventure and High-Tech Gründerfonds

Insight Venture leads $165m series-B round for Tricentis

Deal is understood to mark an exit for existing investor Viewpoint Capital Partners

Thrive Capital leads €30m series-C for Raisin

Venture round saw existing investors Ribbit Capital and Index Ventures participate