DACH Unquote

Finexx buys Volpini Verpackungen

GP also announces it has increased the volume of its Finexx II fund to €30m

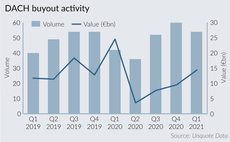

DACH buyouts continue recovery from Q2 2020 low

Both deal volume and value are now back on par with the figures for Q4 2019, prior to the pandemic

Paragon acquires Bregal's Sovendus

Bregal acquired a minority stake in the e-commerce customer reward platform in 2015

SHS sells stake in Medigroba to trade

Medical homecare provider Medigroba received significant inbound interest from strategic buyers

Endeavour Vision closes Medtech Growth II on $375m

Fund is 30% larger than its predecessor and will continue to focus on medtech growth investments

Paragon-backed Apontis Pharma announces IPO intention

Paragon acquired the pharmaceutical business from its parent company UCB in 2018 via Paragon II

Hg's MeinAuto announces intention to float

Hg invested in the new car sales platform in 2018; prior backers included HV Capital and DN Capital

Cusp Capital announces €300m debut fund

Newly launched VC is led by former Tengelmann Ventures partners and managing directors

Patrimonium hires Mogwitz

Ulrich Mogwitz joins the firm's private equity team from impact investor Prorsum

EMH buys majority stake in Cleverbridge

GP is investing in the subscription billing and management software via its €650m EMH II fund

PE-backed diagnostics firm Synlab announces IPO pricing

Shares will be priced at €18-23, equating to a €4-5bn market capitalisation and €5.9-6.9bn EV

Aurelius raises first fund for institutional investors

Investor's тЌ360m fund has an extra capacity of тЌ150m from the GP's listed vehicle and will focus on carve-outs

Battery Ventures buys IMC Test & Measurement

Company will operate with the GP's existing test and measurement companies in the US and Denmark

Hg acquires Auvesy from Brockhaus

Industrial automation software platform is the first investment from Hg's €1.3bn Mercury 3 fund

Summit Partners leads $68m round for Lingoda

Existing investors in the Germany-headquartered online language school include Grazia Equity

Gimv acquires homecare service Apraxon

GP plans to support the at-home wound care specialist through organic growth and a buy-and-build strategy

VCs in $115m round for CeQur

Funding round is the largest ever recorded for a medical equipment company in Switzerland

Klar Partners to acquire ISS Kanal Services

Carve-out is the first DACH-region platform investment from Klar Partners' €600m debut fund

Beyond Capital holds final close for second fund on €115m

Fund surpassed its €100m target and will continue to focus on DACH-based, small-cap, asset-light businesses

KPS to buy Crown's EMEA tinplate packaging business

European packaging sector buyouts in 2021 already exceed the aggregate value recorded in 2020

EY Law hires Schulz

Daniel Martin Schulz joins the firm's Hamburg-based PE and M&A team from Allen & Overy

PE-backed Synlab announces IPO intention

Cinven, Novo Holdings and OTTP hold stakes in the Germany-based laboratory diagnostics group

Waterland acquires software development business GOD

GP's previous IT service sector investments include Germany-based Netgo

Deutsche Handelsbank expands growth finance team

Firm aims to strengthen its venture debt offering via two promotions and a director appointment