Unquote

Mega-rounds fuel record H1 for venture and growth

Largest rounds inked in the first six months of 2021 read like a veritable Who's Who of European fintech heavyweights

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Baird Capital holds final close for second Global Fund

Vehicle will continue to back founder-led UK, US and Asian SMEs via buyout and growth deals

PE buy-side appetite further boosts exit options for sponsors

Secondary buyouts accounted for nearly a third of all PE exits in the first half of 2021, compared with typical levels of 20-25%

VC Profile: DN Capital set to deploy in buoyant European VC market

Managing partner and co-founder Nenad Marovac discusses the firm's deployment plans and its view of the European VC market

GPs increasingly ruling out investments due to ESG – survey

Majority of GPs polled by Investec have declined to invest in a company on ESG or ethical grounds

Unquote Private Equity Podcast: H1 review special

The team looks at key takeaways and numbers across deal-doing and fundraising, and ponders where the market might be headed

H&F holds USD 24.4bn final close for 10th fund

Large-cap buyout specialist closed its predecessor fund in October 2018 on USD 16bn

One in four LPs willing to trade lower performance for better ESG - survey

ESG-focused LPs "motivated to divest positions in funds where they perceive ESG efforts to be lacking"

Five Arrows registers next buyout vehicle

Previous vehicle in the strategy, FAPI III, closed on its EUR 1.25bn hard-cap in 2019

Triago bolsters secondaries team with two NYC hires

Michael T Pilson and Marc Fitorre join as partner and principal, respectively

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Fundraising Report 2021: mapping out the post-Covid landscape

Unquote analyses key trends and presents proprietary data on the European fundraising market

GPs dismiss Spacs' threat to dealflow, pricing - survey

UK-based GPs are most likely to dismiss the threat of Spacs entirely

US, UK ranked as most attractive countries for PE investment – study

France makes it into the top 10 for the first time, while Spain also records strong gains

Spotlight on Spacs: Green power

With an expanded investor universe flush with cash, green may well prove to be gold for Europe's blank-cheque future

European PE buyout activity sets new record in H1

Hectic first quarter drove an unprecedented spike in deal activity, while aggregate value is just shy of hitting an all-time high

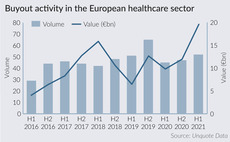

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Rede appoints three new partners

Alexandra Bazarewski, Magnus Goodlad and Bruce Weir all make partner as the firm celebrates its 10th anniversary

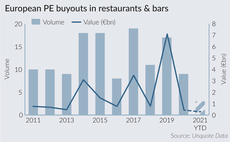

Pandemic sinks dealflow in restaurants & bars to 10-year low

Activity in the sector has not yet returned to previous levels, with four buyouts totalling тЌ285m recorded to date in 2021

Over a third of LPs track GPs on social media - survey

Survey finds that 38% of LPs use social media to track GPs and a further 29% use social media as part of their due diligence on potential investments

Healthcare valuations heat up as high-profile assets crystallise competition

Healthcare sector saw multiple valuations pick up in Q1 2021 and hit a record high of 13.7x

Unquote Private Equity Podcast: Fundraising full steam ahead

With record amounts of capital raised in 2020 and a roaring start to 2021, it seems not even a pandemic could slow the momentum of PE fundraising