Unquote

LGT raises $6bn across two secondaries funds

LGT's $1.5bn CSSO II and its $4.5bn CGS V vehicles will target a range of secondaries deals

OpenGate heads for third fund launch targeting up to $700m

GP is currently investing its second fund, which held a final close on $585m in November 2019

Neuberger Berman launches ELTIF

Fund focuses on buyout opportunities blended with some growth and structured equity

Q1 Barometer: Total European deal value reaches new decade high

The latest Unquote Private Equity Barometer, produced in association with Aberdeen Standard Investments, is now available to download

Appian Capital appoints Pinto as chief financial officer

Pinto will lead the investment strategy of Appian, which specialises in assets across the mining sector

Top Tier Capital closes European fund on €260m

Fund makes primary and secondary investments in venture capital funds and co-investments in select portfolio companies

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

PE funds raised in pandemic increasingly target TMT opportunities

GPs' origination preferences and 2020 investment volume have already shown a clear shift to technology investments, with new fundraises following suit

Eurazeo sells 49% stake in Trader Interactive in $1.6bn deal

With this sale, Eurazeo reaps a 1.5x return on its initial investment, made in 2017 alongside Goldman Sachs

Debt funds celebrate strong dealflow following Covid stress-test

Direct lenders now see shift away from refinancings and towards new deals, including 2020 processes coming back to life

17Capital makes raft of senior promotions

Firm appoints new managing partner and two new co-heads of credit

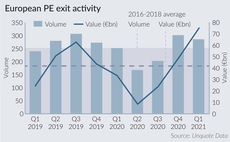

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

Flexstone reaches $322m second close for co-invest fund

Firm is gearing up to announce a fourth co-investment deal for Global Opportunities IV in May

Founders Circle closes third fund on $355m

Fund deploys flexible capital to meet the needs of growth-stage companies and support their expansion

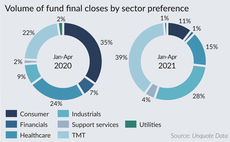

Fundraising fortunes: prevailing LP preferences persist

Alessia Argentieri looks at the winning strategies, and gathers insight from placement specialists as to what the rest of 2021 has in store

Tikehau's SPAC Pegasus raises €500m

Tikehau, FinanciУЈre Agache, Jean-Pierre Mustier and Diego De Giorgi commit to invest a total amount in excess of тЌ165m

Ares closes Ares Capital Europe V on €11bn

Ace V is Ares' largest institutional fund yet and is 70% larger than its тЌ6.5bn predecessor

Dorilton launches venture strategy to target tech companies

Dorilton Ventures will lead significant minority investments in early- to mid-stage data-centric technology companies

LeadBlock plans €100m second close for blockchain fund

Fund held a first close on тЌ10m in March this year and will invest at the seed and series-A stages

Inflexion and Informa combine FBX, Novantas

Inflexion and Novantas will each own a minority stake in the newly formed financial data business

Digital Alpha Fund II closes on $1bn

Fund invests in digital assets, with a focus on next-gen networks, cloud computing and "smart cities"

AlpInvest Co-Investment Fund VIII closes on $3.5bn

ACF VIII invests alongside GPs in private equity buyouts and growth capital transactions across a variety of sectors

Unquote Private Equity Podcast: Onwards and upwards for Jersey

The Unquote Private Equity Podcast welcomes back Jersey Finance to discuss what the jurisdiction can offer private equity GPs

Searchlight hires new global head of value creation

Amanda Good joins from Hg as partner; she has prior experience with Bain & Company