Unquote

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater

EU FSR could impact PE fundraising with potential rise in 'clean funds'

FSR could lead GPs to create funds without foreign LPs; red tape around sovereign wealth funds likely

Letter from the editor: Unquote is moving to Mergermarket

Unquote Editor Harriet Matthews outlines Unquote.com's upcoming move to the Mergermarket platform and the new capabilities and intelligence that this brings to Unquote readers

IPO offers CVC chance to become multi-asset consolidator

Potential IPO also offers monetisation solution for founders and GP stakes investor Blue Owl

Morgan Stanley nears EUR 1.6bn-plus first close for maiden European direct lending fund

Investment manager started marketing fund to LPs last year; expects to raise in excess of EUR 3bn

Turning the tables – an M&A downturn means investment banks are now targets themselves

Some dealmakers with healthy balance sheets and willingness to go countercyclical are pursing acquisitions

VC Profile: RTP Global gears up to deploy largest fund to date, remains bullish on breakout opportunities

Partner Gareth Jefferies discusses early-stage deployment plans and advantages of supporting startups throughout their lifecycle

Kudu to step up boutique GP stake deals in Europe

MassMutual-backed investor aims to add more infrastructure and specialised equity GPs to its portfolio

Bain Capital intensifies strategy specialisation efforts with USD 1.15bn insurance fund

New fund will deploy tickets of up to USD 200m but is 'not afraid to start small', Matt Popoli said

AnaCap in advanced talks for two deals; has 'exciting' financial services and tech pipeline

Financial services-focused sponsor is honing in on one majority and one minority stake deal

PAI Partners nears close for EUR 7bn Fund VIII following timeline extension

France-headquartered firm is expected to close the vehicle in November 2023 amid a tough fundraising climate

Unquote Private Equity Podcast: In conversation with... Alex Walsh, Blackstone

Senior Managing Director Alex Walsh discusses topics including his career in the PE industry, LGBTQ+ representation and inclusion, and the current macro environment

CVC raises Europe's largest ever buyout fund, securing EUR 26bn for ninth vehicle

Fund was launched in January 2023 and surpassed its EUR 25bn target, the GP said in a statement

Ayre Group's VC arm eyes 10-15 blockchain deals this year

Family office-backed firm plans to invest at seed and Series A with tickets of USD 2m-USD 3m

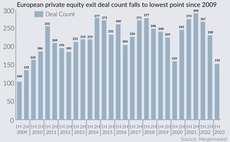

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

Esquare Capital Partners seeks entrepreneur commitments for second, EUR 25m tech platform

Dutch investor aims to connect entrepreneurs with tech investment appetite to startups seeking capital

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve OтHare about the GPтs approach to its recent realisations

Portable refis pave way for smoother sponsor exits in rocky market

Sellers are aiming to bolster buyer confidence, securing debt that can be transferred to the next LBO

Wellington eyes late-stage growth opportunities with new USD 2.6bn fund

GP seeks to address capital needs pre-IPO or sale and anticipates a diverse portfolio for fourth fund

The Bolt-Ons Digest - 3 July 2023

Unquoteтs selection of the latest add-ons with Palatine's Anthesis, Nordic Capital's Regnology, Waterland's Janssen and more

RTP Global holds final close for fourth fund on USD 1bn

Fundraise is New York-headquartered early-stage venture capital firmтs largest to date

Many-headed Hydra: Private markets manager consolidation rears its head

Multi-asset managers set to roll-up credit, infrastructure and secondaries players to add strategies for scale

Unquote Private Equity Podcast: PE perspectives from Berlin

Unquoteтs Min Ho and Rachel Lewis digest the key takeaways from this yearтs SupeReturn