Amundi Private Equity

Amundi to raise fourth small-cap fund

French asset manager sets the target for the fund at €150m and plans a final close in H2 2018

Amundi holds final close on €665m for private debt fund

Marketing materials for the fund, circulated in March 2017, mentioned a target of €700m

Amundi acquires minority stake in Greenoffice

Fresh capital will be used to support the company's international expansion into the US

Amundi buys minority stake in RCF Group

Deal is the first acquisition in the Italian market for the French fund manager

Amundi takes minority stake in Groupe Bernadet

Amundi is taking over from previous investor Siparex, which first invested in Bernadet in 2007

Arve Industries Capital, BPI in €5m round for AlpenTech

GPs join previous backers Crédit Agricole des Savoie Capital and BP Aura to support the precision engineering group

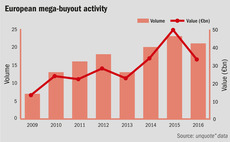

unquote" data snapshot: the five biggest buyouts of 2016

The year’s two largest deals, somewhat unusually, took place in Italy and Poland

Amundi buys Pioneer from Unicredit for €3.5bn

Transaction is expected to generate a €2.2bn net capital gain for Unicredit in 2017

Amundi targets €250m for new European investment programme

An €136m EV investment marked the first deal made through the programme

BPI, Amundi et al. in €16.5m round for Pernat Industrie

Group had received €4.84m from Siparex, Crédit Agricole des Savoie and Amundi in 2013

BPI, BNP and Amundi in €10m round for Splio

Transaction marks first funding round for the French SaaS group, founded in 2001

Amundi launches platform for real and alternative assets

Firm is looking to double its €34bn alternative assets under management by 2020

UI Gestion and Sofipaca sell Villas Prisme to Amundi et al.

GPs acquired respective 52% and 8% stakes in residential constructor through 2008 OBO

Amundi et al. back Numerix bolt-on of GIOL

New investors back bolt-on with capital increase

Amundi PEF buys FrogPubs from Ciclad

Company is planning on rapid expansion through opening new venues

NCI becomes majority shareholder of Didactic

UI Gestion and BPI France exit the business

VC-backed McPhy raises €32m in IPO

Offer oversubscribed by 8.6x

VC-backed McPhy to float on Euronext

Company could raise up to €24.2m

Omnes divests Melkonian in SBO

Omnes Capital has sold Melkonian Group, a French provider of mining equipment, to BPI France, Amundi Private Equity Funds and Sofipaca.

Amundi et al. invest €1.3m in Envie de Fraises

Amundi Private Equity Funds, Generis Capital Partners and Calao Finance have injected €1.3m into Envie de Fraises, a French online clothing store for pregnant women.

FSI Régions et al. back Groupe SAF

FSI Régions, CDC Entreprises, BNP Paribas Développement, Amundi Private Equity, Crédit Agricole des Savoie Capital and Portuguese trade player United Helicopter Service (UHS) have invested in French helicopter rescue business Groupe SAF.