Austria

Carlyle invests in logistics automation company Agilox

GP is investing in the Austria-based logistics automation startup via its €1.35bn CETP IV fund

Russmedia Equity buys secondhand sales platform Shpock

GP aims to develop the Austria-headquartered online marketplace into a leading player in the UK

Lindsay Goldberg sells Schur Flexibles to trade

GP acquired the packaging producer from Capiton in 2016 and will retain a 20% stake in the business

Q1 DACH VC and growth deals surpass previous volume high

Deal volume has grown steadily since Q2 2019; aggregate value has also been rising since Q2 2020

Finexx buys Volpini Verpackungen

GP also announces it has increased the volume of its Finexx II fund to €30m

DACH buyouts continue recovery from Q2 2020 low

Both deal volume and value are now back on par with the figures for Q4 2019, prior to the pandemic

VCs in $170m round for trading platform Bitpanda

According to Unquote Data, the round is the largest ever recorded for an Austrian company

DACH Fundraising Pipeline - Q1 2021

Unquote compiles a roundup of the most notable fundraises ongoing across the DACH market, including Capiton, Afinum, Gyrus, Cipio, and more

DACH exit rebound expected in H2 2021

DACH PE players completed 16 exits in January 2021, compared with 14 in January 2020, hinting at signs of a gradual recovery

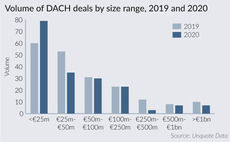

DACH small-cap deals weather the storm

Small-cap dealflow remained fairly stable in the DACH region in 2020, despite the coronavirus crisis

DACH venture and growth deals peak in crisis

Following a strong year in volume terms, market participants remain optimistic about the resilience of the venture ecosystem

2021 Preview: Dry powder drives DACH prospects for 2021

DACH players adopted increased portfolio management and defensive investment decisions in 2020, but dry powder is set to drive 2021

Accursia acquires GA Actuation Systems

Automotive and aviation original equipment manufacturer was sold in a process led by Carlsquare

GP Profile: PAI to step up DACH deal-making

Ralph Heuwing, recently appointed partner and head of DACH, discusses the regional focus with Harriet Matthews

Bregal Milestone to wholly acquire Greenstorm

Bregal has owned a minority stake in the Austria-based e-bike company since December 2018

Speedinvest holds first close for Speedinvest x Fund 2

VC also announced the appointment of Tier Mobilty co-founder Julian Blessin as partner

DACH Fundraising Pipeline - Q4 2020

Unquote compiles some of the most notable fundraises in the DACH region in the buyout, venture and secondaries spaces

Ardian sells Gantner to Alantra-backed Salto

Deal is financed with a €125m capital increase deployed by Alantra, alongside Sofina, Peninsula and Florac

Argand-backed Cherry buys Theobroma Systems

Argand Partners acquired gaming hardware and software company Cherry from Genui in September 2020

Lafayette Mittelstand Capital buys Geba Cables

Carve-out of the elevator cables producer is the special situations investor's fourth of 2020

Russmedia Partners buys majority stake in Bergfex

Founders of the online Alpine tourism platform will continue to hold a stake in the business

Valar Ventures leads $52m series-A for Bitpanda

Company intends to use the fresh capital to further boost its expansion across Europe and scale up its team

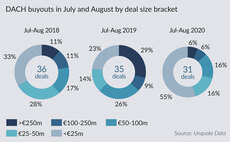

DACH buyout deal value sees sharp summer decline

Following a quiet period for upper-mid-cap dealflow, Unquote gauges market sentiment as to whether activity could pick up before year-end

DACH deal pipeline: live, expected and pulled sale processes

A round-up of sale processes ongoing or expected to launch in the coming months in DACH, courtesy of Unquote sister publication Mergermarket