Austria

Northzone leads €25m series-A for Tier Mobility

Company's existing backers, Point Nine, Speedinvest and Spain-based Kibo Ventures, also take part

DBAG-backed Gienanth buys SLR Gusswerk

Deal includes two companies located in Austria and one Czech metal-working business

Kharis Capital acquires Nordsee from HK Food

Firm is wholly acquired via KC North Sea, an investment vehicle managed by Kharis Capital

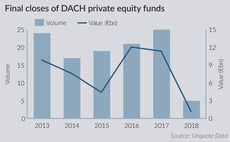

DACH funds still proliferate despite fundraising lull

Fund launches remain at near record levels in the region, as GPs look to further specialisation in order to stand out

EMBL sells ViraTherapeutics to trade for €210m

Acquirer signed a collaboration and option agreement with ViraTherapeutics in August 2016

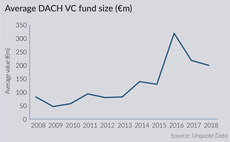

VC fundraising lifts off in DACH region

Six venture funds based in the DACH region have held final closes in 2018 for a combined €1.3bn

DACH leads lower-mid-market fundraising

An overcrowded lower-mid-market in the Nordic region and the UK, coupled with Brexit, has boosted DACH fundraising activity

Opera-backed Vetrerie Riunite sells Technoglas to Cerve

Acquirer will invest up to €30m in the production facilities in Austria, according to Italian press

TCV leads $50m round for TourRadar

Cherry Ventures, Endeit Capital, Hoxton Ventures and Speedinvest round up the series-C

DACH fundraising picks up steam after slow Q1

Funds holding final closes in Q2 have surpassed the total amount raised in the first quarter of the year, following a strong 2017

Sun European buys ESIM from Ardian

Sale ends a three-year holding period for Ardian, which acquired the company in a complex carve-out

VC firms invest €5m in Eversports

Fresh capital will be used to improve the software and roll it out to more sport studios

DACH GPs consider alternative funding models

With three of the region's top five most active GPs investing from non-standard funds in 2017, some other GPs are also adopting alternative approaches

Mangrove leads €3.2m series-A for Adverity

Existing investors Speedinvest, 42Cap and AWS Gründerfonds also take part in the round

Investindustrial acquires Lifebrain

Lifebrain was initially funded with capital raised from several Austrian private investors

Japanese insurance companies eye DACH funds

Insurance companies in Japan are considering increasing their exposure to European funds, with DACH GPs most likely to benefit

Triton appoints Watters to debt opportunities team

In his new role, Gordon Watters will provide operational scrutiny for investments

VR-backed Hör Technologie buys Pichler & Strobl

Second bolt-on in quick succession after the acquisition of Neustadt-based Fischer CNC-Technik

Agic, Capvis, Gilde, Nordic Capital in final Amann Girrbach round

Nordic Capital is reportedly the front-runner in the sale of the Austrian dental prosthetics company

Egeria's Clondalkin Group sells Cats-Haensel and Nimax to trade

Austrian packaging manufacturer Schur Flexibles buys the confectionery and tea packaging businesses

Genesis, Avallon acquire Triton-backed Eqos Energie operations

Once completed, the Czech and Polish companies will operate under the new brand Stangl Technik

Bridgepoint acquires US-based Safety Technology Holdings

Industrial sensors and safety equipment group consists of two US companies and two European firms

DACH auto-parts deals motor on as sector transforms

Private equity players remain keen on auto-parts, as the sub-sector responds to rapid changes brought about by the electrical vehicle market

AnaCap-backed Heidelpay buys MPay24

Second bolt-on, after the purchase of Hamburg-based Startec, since AnaCap's original acquisition