Exclusive

UK buyout activity sets new record in Q1

UK buyout market is truly back in full swing, according to preliminary figures from Unquote's proprietary database

GP Profile: Capza

Unquote discusses the firm's latest launches, and its outlook on the post-pandemic landscape, with founding partner Christophe Karvelis Senn

Q&A: do not give up on the lower-mid-market, says Monument's Karl Adam

Monument partner Karl Adam tells Greg Gille how an opportunity to break through still exists for lower-mid-market managers in a very top-heavy market

Superhero Capital to close second fund by mid-summer

Fund was previously aiming for a final close by the end of 2020

Unquote Private Equity Podcast: Ravenous for recurring revenue

The Unquote Private Equity Podcast is back to its regular format this week, with the team looking at PE's appetite for recurring revenue models

Q4 Barometer: How European activity returned to pre-pandemic level

European PE deal value staged an impressive recovery over the course of 2020, capped by a busy Q4

MTIP holds first close for second fund

Digital-health-focused growth investor has a hard-cap of тЌ250m and target of тЌ200m for MTIP Fund II

Hamilton Lane registers latest Large Cap Buyout Club Fund

Hamilton Lane and Scala originally teamed up to launch the line of vehicles back in 2017

UV T-Growth Fund holds €100m first closing

Fund targets late-stage companies, primarily across the 5G, AI, cybersecurity, cloud and Internet-of-Things sectors

L Catterton gears up for fifth European fund

Vehicle makes majority investments in companies operating across the consumer industry in Europe

Iberia Fundraising Pipeline - Q1 2021

Unquote compiles a roundup of the most notable fundraises ongoing across the Iberian market, including Magnum, MCH, Suma and more

Astorg Mid-Cap anticipates summer final close

Fund will make pan-European investments in mid-market companies and has a €1bn target

Astorg buys majority stake in Five Arrows-backed Opus 2

Five Arrows bought a minority stake in the legal technology company in 2017 and will now reinvest

Back to school: education dealflow heats up as pandemic settles

Digital opportunities and long-term growth drivers have resulted in an influx of deals in recent weeks, with more in the pipeline

Nordic Fundraising Pipeline - Q1 2021

Unquote rounds up notable fundraises ongoing across the Nordic market, including EQT, Axcel, CapMan, Saga, and more

Cairngorm eyes £200m final close in July

Fund's predecessor, Cairngorm Capital Partners II, reached a final close on ТЃ107.5m in April 2017

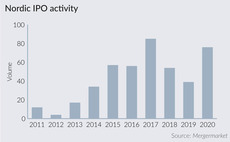

Nordic IPO rush drives exit opportunities for GPs

Wave of Nordic IPOs shows no signs of receding this year, often driven by new opportunities emerging from the pandemic

Armada Credit Partners closes fifth fund on €210m

Fund V is already 50% deployed and has made seven investments so far

UK & Ireland Fundraising Pipeline - Q1 2021

Unquote rounds up the most notable fundraises currently ongoing in the UK & Ireland market across the buyout, venture and debt spaces

Klar Partners closes debut fund on €600m hard-cap

GP started raising the fund in March 2020 and said the vehicle was "significantly oversubscribed"

European fund launches off to slow start in 2021

Number of PE funds launched by European managers in Q1 this year is significantly down on the volume recorded for the same period in 2020

Podcast: In conversation with... Jan Kengelbach, BC Partners

Portfolio operations partner Kengelbach shares his experience and lessons learned from getting hands-on with portfolio company Aenova

Inflexion sells Kynetec to Paine Schwartz Partners

Fourth exit in four months sees the GP net returns of more than 3x money and a 25% IRR

Riverside Europe VI closes on €465m

REF VI invests in European companies with high-growth potential, generating EBITDA of тЌ5-30m