Exclusive

Longevitytech.fund to resume fundraising in early September

Fund aims to hold a second close on $2-3m by February 2021 and to raise the remainder within a year

Q2 Barometer: Coronavirus ravages European M&A market

After the first effects of the Covid-19 crisis were felt in March, the European private equity market decelerated sharply in Q2

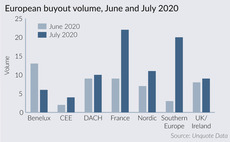

Southern Europe bounces back amid pandemic uncertainty

Southern European market has regained vigour and confidence in July following a catastrophic H1

Capital D to launch next fund in Q4

Capital D is investing from a fund and its side vehicle, which closed on тЌ100m in October 2018

EQ Asset Management eager to deploy following double fund close

EQ says it has completed five acquisitions through its secondaries fund since the outbreak of Covid-19

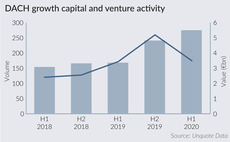

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

GP Profile: FPE Capital

FPE Capital is now gearing up to begin making investments again in the technology sector, says managing partner David Barbour

Nordic PE exits hit new low in Q2

Volume of exits by PE firms across the Nordic countries in Q2 2020 fell to its lowest point in more than a decade, according to Unquote Data

Debt funds making inroads in DACH amid Covid-19, says GCA

GCA's Mid Cap Monitor shows that debt funds financed 71% of German LBOs in H1 2020, with the firm expecting an activity uptick in Q4

Venture, tech keep UK market afloat in H1

Buyout and exit volume dropped dramatically in the first half of 2020, while GPs are doubling down on technology-driven strategies

La Famiglia announces second fund

B2B-focused venture capital fund has made eight investments so far and is targeting €50m

Unquote Private Equity Podcast: Made in Germany

This week, the Unquote Podcast focuses on Germany, where private equity activity has remained resilient despite Covid-19

Bolster Investments buys minority stake in Infoplaza

Weather data provider uses the proceeds to fund the acquisition of market peer Weeronline

Kester Capital closes second fund on £90m

GP also announced the refinancing of online gardening retailer YouGardem, scoring a 60% cost return

Bid Equity buys majority stake in Infopark

Deal is the second from Bid Equity II, which held a close in November 2019 and targets B2B software

Priveq acquires majority stake in Trendhim

Company in 2019 generated revenues of DKK 115m, the equivalent of тЌ15.4m

Jet Investment plans Jet 3 launch for late 2021

New vehicle's target is almost double the €153m that Jet raised for its second fund

France, southern Europe drive dealflow uptick in July

Buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier

ICG launches second recovery fund

Second vehicle will be larger than its predecessor, which closed on тЌ843m in March 2010

How the crisis could affect fund T&Cs

In a tough funrdriasing and deal market, GPs will be looking for all the incentives they can possibly provide

CapMan announces second growth fund; invests in DSP Neural

VC fund has made its first investment in DSP Neural, which raised тЌ5m in a series-A round

Armonia to launch €500m fund

Fund will be larger than its predecessor, which closed on €280m in July 2018

Finland's VC industry remains buoyant despite pandemic

Dealflow in the Finnish VC market remained strong in the peak months of the coronavirus outbreak, with local players cautiously optimistic

GP Profile: Tenzing Private Equity

Following a busy start to 2020, topped by its ТЃ400m fundraise, Tenzing is setting its sights on making further investments later this year