Finland

CapMan's Harvia lists with €93.5m market cap

Total value of the shares is expected to correspond to a market cap of around тЌ93.5m

Finnish newcomer Maki.vc launches with €70m target

Backers of the fund to date include Skype's founder, the Supercell co-founders, and Nokia's chair

Capman launches infra fund

Manager is currently in discussions with placement agents and legal advisers on the raise

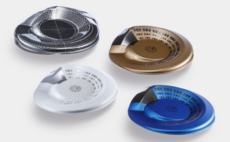

CapMan prepares Harvia for IPO in Helsinki

Harvia intends to raise around тЌ45m to strengthen its capital structure and support growth

Nordic tech's transatlantic ambition

Nordic startups are increasingly looking to find backers with ties to the US market to support their growth strategies

Vaaka Partners acquires Framery

Vaaka invested in the firm via its latest vehicle, Vaaka Partners Buyout Fund III

Draper Esprit invests in five seed funds

Managers include Berlin-based Join Capital and Helsinki-based Icebreaker

Inventure, Tesi raise $2.4m for Thirdpresence

Deal marks the first investment from Inventure Fund III, which held a first close on тЌ110m

EQT Ventures leads $41m round for Small Giant Games

Participants in the round include existing investors Creandum, Spintop Ventures and Profounders

Adelis exits Med Group after three-year holding

Firm saw its turnover double to тЌ100m and the number of employees increase from 800 to 3,000

Ascend Capital backs TactoTek in $23m round

TactoTek will use the fresh capital to expand operations and production capacity

Tesi leads €6m funding round for Zervant

Zervant plans to use the investment to grow the use of electronic invoicing for micro-businesses

CapMan rolls out incentive plan for top team

Performance will be determined based on personal records and company returns, commencing 1 April

EQ launches new secondary fund

Simultaneously to the launch, EQ also held a first close for its fund-of-funds EQ PE X North

EQ PE X North holds first close on €83m

Fundraising will continue during Q2, and a final close on тЌ175m is planned for June 2018

MB Funds acquires Pohjolan Energia

Solar energy firm intends to bolster its growth plans in Finland and internationally

Conor to raise third technology fund

Target size of the latest vehicle is around double the amount raised by its predecessor

Litorina acquires Bergfalk

Deal is the second investment from the Litorina V fund, following Digpro in November 2017

Triton-backed OptiGroup completes bolt-ons in Romania, Finland

Acquired businesses are expected to post a тЌ50m combined turnover, according to OptiGroup

Sentica acquires Purkupiha and Dammega

Finnish GP has bought majority stakes in the Helsinki-based demolition businesses

Sponsor Capital acquires majority stake in Myllyn Paras

Transaction includes the company's operations and two production facilities in Finland

Madison Dearborn sells Finland-based Powerflute for €365m

Transaction comes only a year after Madison Dearborn Partners acquired a majority stake

Fundraising record rounds off active year for Nordic region

Region saw strong fundraising and high deal volume off the back of low interest rates in 2017

IK's OpenSolution bolts on Finnpos

OpenSolution intends to grow geographically in the Nordic region following the deal