Italy

Star Capital SGR holds first closing

Italian investor Star Capital SGR has held a first closing on more than €70m for Star III, a fund aiming to back Italian SMEs.

Alto Partners backs MBI of Virosac

Alto Partners has backed the management buy-in of environmentally-friendly household products company Virosac.

Sator and Palladio appeal rejected by courts

Italian private equity houses Palladio and Sator have had their appeal against the proposed merger of Unipol and Fondiaria-SAI rejected by the national courts.

Fondo Italiano backs Megadyne

Fondo Italiano di Investimento has invested €20m in Italian belts and pulleys manufacturer Gruppo Megadyne in exchange for a minority stake.

21 Centrale Partners creates outdoor accommodation group

21 Centrale Partners has created an outdoor accommodation group by merging its portfolio company Vacances Directes with newly acquired business Village Center.

Fondo Italiano provides capital to Hat Holding

Fondo Italiano di Investimento has committed capital to Italian investment company Hat Holding, allowing the firm to shift its focus from club deals to investments from a closed-end fund.

€1.7bn bid for Rottapharm stalls

The bid launched by Clessidra Capital Partners and Avista Capital Partners for Italian drugmaker Rottapharm has ground to a halt due to share governance issues and fundraising difficulties.

The State at play: Italian government jumpstarts flat market

The State at play

Vertis backs Blomming

Italian investor Vertis has backed social network e-commerce site Blomming.

Italian and Russian banks to launch joint venture

Italian banking group Intesa Sanpaolo and Russian bank Gazprombank have signed an agreement to make private equity investments in medium-sized local companies.

Fondo Italiano injects €5m into Antares

Fondo Italiano di Investmento has acquired a minority stake in Italian artificial vision systems producer Antares Vision via a €5m investment in holding company Imago Technologies.

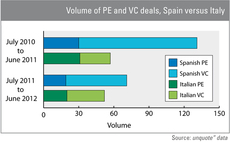

Spain continues to outperform Italy in deal volume

Despite the country's dire economic state, Spanish private equity activity has continued to outpace that of Italy continuously over the past 24 months - although the latter showed more resilience last year.

Permira sells Valentino to Qatari investors

Permira has sold Valentino Fashion Group to Mayhoola for Investments, a vehicle backed by a Qatari private investor group, in a deal believed to be valued at around €700m.

Fondo Italiano invests €10m in EMARC

Fondo Italiano di Investimento has injected €10m into italian industrial group EMARC in exchange for a minority stake.

Providence acquires HSE24 from AXA PE

Providence Equity has acquired Germany-based international home shopping group Home Shopping Europe (HSE24) from AXA Private Equity for an estimated €650m.

Filas injects €1.2m into iLike.Tv

Italian regional investor Filas has injected €1.2m into online streaming and social media platform iLike.Tv.

Buyers consider Permira-backed Valentino

A sovereign wealth fund is to make an offer for Italian fashion brand Valentino Fashion Group, owned by Permira.

Have your say: where is the Italian market going?

unquote" is looking for your views on the Italian private equity market, ahead of our Italia Congress in November.

21 Centrale Partners buys Village Center

21 Centrale Partners has acquired outdoor accommodation group Village Center from NYSE Euronext Paris-listed Promeo Group.

Caryle acquires Light Force

The Carlyle Group has acquired a majority stake in Light Force, the producer and distributor of women’s clothing brand Twin-Set Simona Barbieri, from DGPA Capital and the company’s founders.

Sator and Palladio table third offer for Fondiaria

Italian private equity houses Sator and Palladio have made a third offer for troubled insurer Fondiaria.

Montagu buys St Hubert for €430m

Montagu Private Equity has completed the €430m management buyout of French spread producer St Hubert from Dairy Crest Group.

Pamplona increases stake in UniCredit Group to 5%

Pamplona Capital Management has increased its stake in banking group UniCredit by 3.02%, making it the second largest shareholder with a total of 5.01% of the group.

AXA PE buys Novotema from 3i

AXA Private Equity has completed the secondary buyout of Italian rubber components manufacturer Novotema Group from 3i.