LDC

Lower mid-cap renaissance for London in 2012

London was home to a noticeable dealflow uptick in the ТЃ5-50m segment last year, with both activity volume and overall value up by more than 30% on 2011 figures.

LDC marks hat-trick with Ramco investment

LDC has backed the buyout of Scotland-based oil & gas services business Ramco, the third deal announced by the firm in quick succession.

LDC backs NRS Healthcare MBO

LDC has taken a stake in the ТЃ24m management buyout of NRS Healthcare, the healthcare division of listed multi-channel retailer Findel plc.

Arlington backs MB Aerospace MBO

Arlington Capital Partners has backed the secondary management buyout of UK- and US-based aerospace engineering group MB Aerospace from LDC.

unquote" Regional Mid-market Barometer

A rise in alternative lenders and a strong trade buyer presence helped drive the UKтs mid-market in 2012, according to the latest unquoteт Regional Mid-market Barometer, published in association with LDC.

LDC backs Fever-Tree

LDC has taken a 25% stake in Fever-Tree, valuing the UK tonic water and mixers brand at ТЃ48m.

LDC CEO becomes chairman of E2Exchange

LDC CEO Darryl Eales has been appointed chairman of E2Exchange while entrepreneur Hugh Chappell joins the company's board as director.

LDC backs barriers manufacturer ATG Access

LDC has made a minority investment in ATG Access, a British manufacturer of vehicle barrier systems.

Lion Capital buys GHD from Montagu

Lion Capital has acquired UK-based professional hair styling brand GHD from Montagu Private Equity for an estimated ТЃ300m.

PE houses circle Côte Brasserie

Private equity firms including LDC, Bridgepoint and Equistone are due to bid for UK-based restaurants chain CУДte Brasserie next week, according to media reports.

LDC backs OnApp in series-B round

LDC has led a series-B round of funding for London-based cloud services company OnApp, bringing the total amount raised by the business to more than $20m.

UK private equity's 2012 highlights

2012 in review: UK

Sun European Partners buys Paragon Print & Packaging

Sun European Partners has acquired a majority stake in British label maker Paragon Print and Packaging from Equistone, LDC and the management team.

LDC invests in Blue Rubicon

LDC has taken a majority stake in UK-based PR consultancy Blue Rubicon, in a deal that values the business at ТЃ30m.

BGF recruits LDC's Swarbrick

The Business Growth Fund (BGF) has appointed LDC senior director John Swarbrick as head of portfolio.

UK lower mid-market resilient in 2012

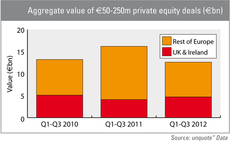

While activity in the тЌ50-250m segment has failed to improve on 2011 figures on a pan-European level, the UK is proving to be fertile ground for deal-making in an otherwise troubled macroeconomic environment.

LDC backs Keoghs

LDC has invested in Keoghs, a UK legal services provider recently approved as an Alternative Business Structure.

LDC appoints director for Reading office

LDC has appointed Alastair Weinel as director in its Reading team, which oversees LDC's operations in the south of the UK.

Unquote" Regional Mid-Market Barometer

The latest unquote" Regional Mid-Market Barometer, produced in association with LDC, shows that mid-cap investors are not letting a lacklustre economy hamper their ability to close deals.

LDC's A-Gas buys US-based Coolgas

LDC-backed A-Gas International has bought Coolgas, a US-based refrigeration supplier and distributor.

LDC backs Forest Holidays MBO

LDC has backed the management buyout of rural holiday accommodation specialist Forest Holidays.

LDC exits Direct Group in trade sale

LDC has sold UK-based outsourced insurance services provider Direct Group to Ryan Specialty Group.

LDC appoints investment director

LDC has appointed Andrew Hampshire as an investment director in its value enhancement group.

Garner to head LDC Yorkshire & North East

John Garner (pictured, left) is to head up LDCтs business in Yorkshire and the North East as the firm looks to increase its activities in the region.