Netherlands

AXA Private Equity's Sfinc acquires JADICO

AXA Private Equity's portfolio company Sfinc, a Belgian manufacturer of ingredients for the food processing industry, has acquired Netherlands-based JADICO.

Strong private equity interest for Catalpa

According to reports six private equity houses have made a first offer for Dutch childcare provider Catalpa.

Call centre investments: Supporting the recovery

During the downturn, private equity firms invested defensively, particularly in the outsourced services sector. Now the economy is recovering, investors are looking to benefit from what is widely seen as a consolidating market. Mareen Goebel gives an...

Apollo supports LyondellBasell restructuring

Apollo Management has backed the debt restructuring of chemical giant LyondellBasell allowing the company to emerge from the bankruptcy declared in January 2009.

Gimv invests €4.7m in RES Software

Belgium-based pan-European investor Gimv has invested €4.7m in Dutch company RES Software, a company specialising in user workspace management.

KKR and CVC-backed Van Gansewinkel mulls IPO

Van Gansewinkel, owned by Kohlberg Kravis Roberts & Co (KKR) and CVC Capital Partners, is reported to be preparing its initial public offering.

Benelux unquote" April 2010

If there is one rule that prevails over private equity commentary nowadays, it is that determining any long term trend remains extremely difficult; such is the volatility in the market. The effect on the retail sector is particularly evident. KKR-backed...

The beauty of small things

If there is one rule that prevails over private equity commentary nowadays, it is that determining any long term trend remains extremely difficult, such is the volatility in the market.

HenQ Invest leads round for Libersy

Dutch VC, HenQ Invest has led a round of financing for software company Libersy, alongside a group of existing shareholders.

Deutsche Bank loses spot in NXP IPO

According to reports, KKR is said to have taken Deutsche Bank off the list of underwriters for its impending IPO of Dutch semiconductor business NPX .

Amadeus et al. in €7m D-round for Liquiavista

Returning investors Amadeus Capital Partners, GIMV, Prime Technology Ventures and Applied Ventures have participated in a €7m series-D round for Dutch display manufacturing company Liquiavista BV.

3i takes minority stake in Refresco in €84m deal

3i has taken a 20% stake in Dutch beverage manufacturer Refresco in an expansion deal valued at €84m.

Venture away

Let’s face it, European venture has not got the best standing with global LPs – a result of the tech bubble bursting a decade ago. Although the market should be defined as maturing by now, such generalisations are not easily applicable to a continent...

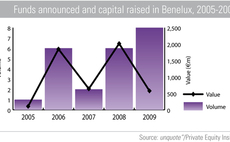

Fundraising set for 2010 uptick after defiant year

According to figures to be published in the upcoming European Fundraising Review 2010, fundraising in the Benelux region has remained resilient in 2009 in spite of the downturn.

OFI-backed IMV Technologies acquires NIFA

OFI Private Equity Capital-backed biotech firm IMV Technologies has wholly acquired has wholly acquired sector player NIFA’s shares from its founding shareholders.

Alvarez & Marsal expand services across Benelux

International bankruptcy advisory firm Alvarez & Marsal (A&M), appoints two to its Benelux practice as it broadens its service offering across the region.

Rabo Capital sells stake in Itho Group BV

Rabo Capital, part of Rabo Private Equity (the captive private equity division of Rabobank Group), has sold its majority stake in Itho Group BV to Bencis Capital Partners.

Q&A: Fundraising in 2010 and beyond

Charlie Jolly principal at Matrix talks to Francinia Protti-Alvarez about recent fundraising trends and implications for the future.

Q&A: Early-stage evolution

Bart Diels, partner at Belgian investor Gimv, speaks to Francinia Protti-Alvarez about how the venture market in the Benelux region has adapted to the changing economic climate.

PTV and Sunstone invest €2.5m in Layar

Prime Technology Ventures (PTV) has together with Sunstone Capital, led a €2.5m series A round for Dutch augmented reality (AR) platform provider Layar.

Bencis-backed Quaron to be acquired by Univar

Bencis Capital has agreed to sell its chemical manufacturer Quaron Group to trade player Univar.

Aescap-backed Biocartis acquires Philips Technology Platform

Aescap-backed molecular diagnostics company Biocartis has acquired Philips’ technology platform for rapid fully-automated DNA/RNA molecular diagnostic testing.

General Atlantic appoints senior advisor for Europe

General Atlantic (GA) has appointed Mike McTighe as special advisor to the firm in Europe.