Silicon Valley Bank (SVB)

Eight Roads and Kennet in £11.5m round for Rimilia

Rimilia secured a new funding facility of ТЃ7m with Silicon Valley Bank in October 2019

Accel-KKR leads $50m round for Partnerize

Accel-KKR principal Joe Porten will join the Partnerize board of directors as a part of the deal

Investec, SVB provide £50m NAV facility to Draper Esprit

Loan has a three-year term and carries an interest rate at the Bank of England base rate +6.75%

Vespa backs Feefo MBO

GP is currently investing from its ТЃ120m fund, which typically invests in deals valued at ТЃ10-70m

VC-backed Azimo raises further $20m

Corporate venture player Rakuten Capital leads the investment again, alongside a host of backers

Turbo-charged: How leverage is powering up secondaries

The use of leverage in secondaries has soared, as funds are continually seeking new ways to boost spending power

Silicon Valley Bank hires Rees as market manager

Gavin Rees joins the US-based high-tech-focused commercial bankтs UK office

Octopus leads £12.9m series-B for Property Partner

Crowdfunding platformтs round includes ТЃ3m debt facility provided by Silicon Valley Bank

Telensa raises $18m from ETF and SVB

Cambridge-based Telensa has developed energy-efficient street light applications

SEP et al. in £9.5m series-C for SportPursuit

Round brings total raised to ТЃ19m

SVB appoints new managing director

Wibke Pendse returns to Europe after 10 years in Silicon Valley

Fintech: throwing down the gauntlet to financial services

Financial technology dealflow is growing at a steady pace and the banks are taking note. Amy King investigates the drivers and challenges behind the fintech revolution.

Braemar et al. back Sefaira

Braemar Energy Ventures, Chrysalix SET and Hermes GPE have invested $7.2m in Sefaira alongside a $2m debt facility provided by Silicon Valley Bank.

Greycroft and iNovia back Tagman

Greycroft Partners and iNovia Capital have led a $5m funding round for UK-based Tagman, a global tag management system (TMS) provider.

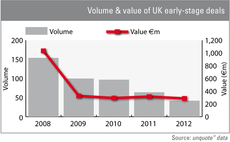

Value of UK early-stage investments holds steady

UK early-stage deal numbers are dropping off, but the total value invested has held steady over the last four years.

A happy New Year for venture capital?

Happy New Year

Interview: SVB's Allan Majotra

Anneken Tappe speaks to Allan Majotra, director of Silicon Valley Bank’s Private Equity Services Group, about the role of funds-of-funds and regulatory developments.

Silicon Valley Bank provides credit to Carlyle's The Foundry

Silicon Valley Bank (SVB) has provided a new credit facility to Carlyle's software holding The Foundry.

SVB makes two senior hires for PE team

Silicon Valley Bank (SVB) has appointed a new director and new relationship manager for its UK private equity services group.