United Kingdom

Agilitas invests in Impetus Waste Management

Pan-European investor Agilitas has supported the management buyout of Impetus Waste Management.

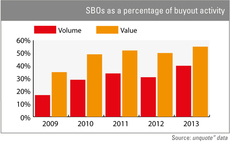

SBOs hit new peak in 2013

Secondary buyouts rose to new levels of prominence in the European market last year, accounting for 40% of all buyouts and 55% of aggregate buyout value. Greg Gille reports

Cerea and BPI France carve out Chesapeake division

Agribusiness-focused Cerea Partenaire and French state-backed BPI France have acquired the speciality chemical packaging division of Chesapeake.

Index injects $21m into The Cambridge Satchel Company

Index Ventures has invested $21m in satchel maker The Cambridge Satchel Company.

HgCapital becomes fifth PE backer of Zenith

HgCapital has acquired car rental company Zenith Vehicle Contracts Group from Morgan Stanley Global Private Equity (MSPE).

VC-backed Egalet files $45.5m IPO

UK-based pharma company Egalet, backed by a consortium of venture capital firms, is seeking to raise up to $45.5m in its IPO on the Nasdaq.

Sovereign's Cordium picks up HedgeStart

Sovereign Capital has backed Cordiumтs acquisition of HedgeStart as it continues its buy-and-build growth strategy.

North West Fund backs BMWQ

The North West Fund for Digital and Creative, managed by AXM Venture Capital, has invested in BeatMyWasteQuote.com (BMWQ), a UK-based B2B online switching platform for waste disposal services.

Balderton et al. invest $14m in Lyst

Balderton Capital has led a $14m series-B funding round, alongside existing backers DFJ Esprit and Accel Partners, for Lyst, a London-based fashion e-commerce site.

Vision's Cortas promoted to partner

London- and New York-based private equity firm Vision Capital has promoted Samer Cortas to partner.

Apax takes full control of Trader Media

Apax Partners has acquired a further 50.1% stake in Guardian Media Groupтs (GMG) Trader Media Group (TMG), securing full control of the company.

Nesta Impact fund deploys £2m in first investments

Nesta Investment Management has made its first social impact investments, deploying ТЃ2m across four businesses.

Albion pours £3.1m into hydro project

Albion Ventures has invested ТЃ3.1m into Green Highland Renewables (GHR), a Perth-based developer of hydropower schemes.

Warburg Pincus acquires Source

Warburg Pincus has agreed to acquire a majority stake in London-based asset manager Source.

LGV's Priestley joins Electra

Bill Priestley, Electra Partners

Deal in Focus: Isis exits Kafevend to trade

Isis Equity Partnersт sale of coffee vending machine company Kafevend to Eden Springs highlights the importance of diversification and flexibility from consumer to contract in the B2B drinks market.

AnaCap's Aldermore raises £40m ahead of IPO

Aldermore Bank, backed by AnaCap, Honeywell Capital Management and Ohio Public Employees Retirement System, has raised a further ТЃ40m from two hedge funds.

Electra buys Hotter Shoes from Gresham

Electra Partners has acquired a majority stake in the secondary buyout of UK shoe manufacturer Hotter Shoes from Gresham Private Equity.

Balderton appoints Chandratillake as general partner

Suranga Chandratillake, Balderton Capital

Accel promotes two to partnership

Philippe Botteri, Accel Partners

Fintech: throwing down the gauntlet to financial services

Financial technology dealflow is growing at a steady pace and the banks are taking note. Amy King investigates the drivers and challenges behind the fintech revolution.

Investcorp sells TDX for £200m

Investcorp has sold debt placement service company TDX Group to NYSE-listed Equifax for ТЃ200m.

Palatine appoints Ashton

Charlotte Ashton, Palatine Private Equity

Amadeus IV Early Stage holds first close on £33m

Amadeus Capital Partners has held the first close of its new fund, Amadeus IV Early Stage, on ТЃ33.2m.